Why a Compliance Consultant? Most legal professionals recognise that proper compliance is not just a legal obligation but a pathway to sustained success. As a COLP or COFA, you face unique challenges in navigating the complex landscape of regulatory requirements. This guide offers you a comprehensive overview of the eight crucial reasons why engaging Compliance Consultant can significantly enhance your practice’s integrity and security. Understanding these steps will empower you to make informed decisions that protect your clients and your reputation.

Key Takeaways:

-

Compliance Consultant provide imperative knowledge of regulatory frameworks, ensuring COLPs and COFAs adhere to legal requirements.

-

They assist in risk management by identifying potential compliance issues before they escalate into significant problems.

-

Compliance Consultant offers tailored training programmes, enhancing the competency of staff in compliance-related areas.

-

Working with Compliance Consultant can improve the efficiency of internal processes, ultimately benefiting the overall practice.

-

They facilitate a more robust compliance culture, promoting ethical practices and fostering trust with clients and stakeholders.

Understanding Compliance Consultant

Your understanding of Compliance Consultant is fundamental to appreciating their role in legal practices. These professionals navigate the complexities of legal regulations and best practices, ensuring that practices adhere to the stringent requirements set by governing bodies.

Definition and Role

There’s no denying that Compliance Consultant are specialists dedicated to assisting organisations in meeting industry standards and regulations. They provide expert advice, risk assessments, and compliance training, thus safeguarding your practice from potential legal issues and enhancing operational efficiency.

Types of Compliance Consultants

Now, it’s important to recognise that Compliance Consultant cater to varying needs within organisations. Each type focuses on specific areas of compliance, whether it be in legal, financial, or operational sectors.

| Type | Description |

| Legal Compliance Consultants | Specialised in legal statutes and regulations. |

| Financial Compliance Consultants | Focus on financial regulations and reporting standards. |

| Operational Compliance Consultants | Ensure internal processes align with industry practices. |

| Environmental Compliance Consultants | Advise on ecological regulations and standards. |

| Data Compliance Consultants | Address data protection laws and cyber regulations. |

Compliance Consultant can significantly enhance your legal practice by ensuring adherence to various compliance needs. They’re necessary in establishing a robust framework within your organisation. By leveraging their expertise, you can not only mitigate risks but also enhance trust with clients and stakeholders.

Knowing the different types within Compliance Consultant can empower your practice to choose the right expertise for your specific needs.

The Importance of Compliance for COLPs and COFAs

The importance of compliance for COLPs and COFAs cannot be overstated. Proper adherence to regulations ensures that your firm operates within the law, safeguarding your reputation and fostering trust with clients. For more insights, check out Getting to grips with COLPs and COFAs.

Key Factors Driving Compliance

While navigating compliance, several key factors come into play:

- Regulatory requirements

- Reputation management

- Client trust

- Risk mitigation

- Operational efficiency

- Legal obligations

The adherence to these elements is vital for maintaining a successful legal practice.

Pros and Cons of Hiring Compliance Consultant

COFAs often face the decision of whether to hire compliance consultants. Evaluating the strengths and weaknesses can be helpful:

Pros and Cons of Hiring Compliance Consultants

| Pros | Cons |

|---|---|

| Expertise in compliance regulations | Cost implications |

| Time-saving | Dependence on external help |

| Reduced risk of non-compliance | Possible misalignment with firm culture |

| Enhanced client confidence | Limited control over processes |

| Access to ongoing training | Potential hidden fees |

Consider these factors closely as engaging Compliance Consultant can lead to both benefits and challenges.

COLPs should weigh the pros and cons of hiring Compliance Consultant thoroughly. While engaging a consultant can provide expert guidance and enhance your firm’s compliance framework, it also introduces financial considerations and potential issues with integrating external insights into your team’s existing culture. The right choice ultimately rests on your firm’s specific needs and operational dynamics.

Step-by-Step Guide to Selecting Compliance Consultant

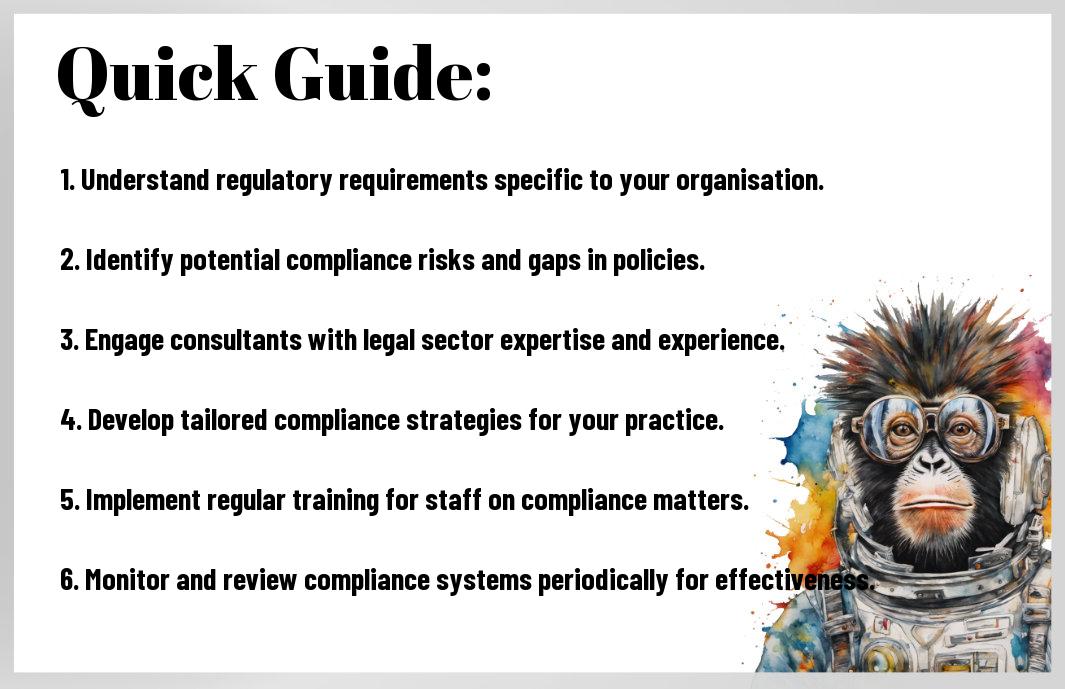

For organisations seeking to enlist Compliance Consultant, it is imperative to follow a structured approach. This guide breaks down the selection process into clear, manageable steps to ensure you make an informed decision tailored to your specific needs.

Table of Steps

| Step | Description |

| 1 | Identify Your Needs |

| 2 | Evaluate Potential Consultants |

Identifying Your Needs

Assuming you are considering Compliance Consultant, start by clarifying your specific requirements. Assess your current compliance challenges and determine the areas where expert assistance would be beneficial. Pinpointing your needs will enable you to select a consultant who can address your unique concerns effectively.

Evaluating Potential Consultants

Step-by-step, you should examine the qualifications and experience of potential consultants. Look for a track record of success in your industry, along with relevant certifications. It’s vital to check their reputation through client testimonials and case studies, ensuring their approach aligns with your organisation’s values and objectives.

Compliance Consultant can significantly impact your organisation. Focus on seeking those with a proven history in compliance, who exhibit a strong understanding of relevant regulations. Institute a robust evaluation process to ensure you are not only choosing someone knowledgeable but also a consultant who can enhance your compliance framework. Prioritise communication skills and expertise in your sector to ascertain a suitable fit, thereby mitigating any potential risks that may arise from non-compliance.

Tips for Working Effectively with Compliance Consultant

To maximise your relationship with Compliance Consultant, keep these tips in mind:

- Communicate openly and regularly

- Be clear about your compliance needs

- Provide all necessary documentation

- Trust their expertise and guidance

- Stay organised and proactive

Knowing how to work effectively alongside them can enhance the outcomes for your role as a COLP or COFA.

Establishing Clear Communication

Effectively communicating with your Compliance Consultant is vital for a successful partnership. Ensure that you share relevant information promptly and ask questions whenever uncertainties arise. This fosters a transparent atmosphere where both parties can engage in meaningful discussions regarding your compliance needs.

Setting Expectations and Goals

Expectations for your engagement with Compliance Consultant should be defined and agreed upon from the outset. This helps both parties understand their roles and responsibilities, ensuring everyone is aligned towards the same goals. It is crucial that you articulate your specific compliance objectives and desired outcomes to facilitate the consultant’s work.

Establishing clear expectations and goals is not merely about outlining tasks; it involves knowing what success looks like for your firm. Be specific about the standards you aim to achieve and the timelines involved to avoid any misunderstandings. By doing so, you are setting your Compliance Consultant up for success, which is fundamental for mitigating potential risks and enhancing your firm’s compliance posture. This proactive approach also helps in creating a sense of accountability on both sides.

Common Challenges in Compliance Consultation

Now, navigating the complexities of compliance consultation can present various challenges. From understanding regulations to ensuring adherence within your organisation, Compliance Consultant must address these issues head-on. It’s necessary for you as a COLP or COFA to recognise these challenges and collaborate with consultants who can guide you towards effective solutions, ensuring that your practice remains compliant and efficient.

Overcoming Resistance to Change

The evolution of compliance practices can often lead to pushback within your organisation. You may encounter colleagues who are hesitant to adapt, fearing the disruption of established routines. As a COLP or COFA, fostering a culture that embraces change and emphasises the benefits of compliance can be vital in alleviating this resistance.

Addressing Resource Constraints

Resistance to change may stem from perceived limitations in your resources—time, budget, or personnel. You might feel overwhelmed at the thought of implementing new compliance measures. It’s necessary to identify how you can optimise existing resources and work effectively with your Compliance Consultant to develop manageable solutions that align with your organisation’s capabilities.

Addressing resource constraints effectively requires a strategic approach. You should assess your current resources and identify gaps that need attention. By working closely with your Compliance Consultant, you can create a tailored plan that focuses on leveraging existing assets while pinpointing potential efficiencies. This collaboration can ultimately lead to better compliance management without overextending your available resources, ensuring that your practice remains compliant while also maximising productivity.

Measuring the Impact of Compliance Consultant

Unlike many other professional services, Compliance Consultant bring a measurable impact on your practice. By implementing structured processes and providing expert guidance, they help you identify compliance gaps, mitigate risks, and ultimately enhance the quality of service provided to your clients. This, in turn, fosters trust and reliability within your firm, allowing you to focus on delivering exceptional outcomes.

Key Performance Indicators

The effectiveness of Compliance Consultant can be assessed through key performance indicators (KPIs). These might include metrics such as the reduction in compliance breaches, improvements in audit outcomes, and enhanced employee training engagement. By regularly monitoring these KPIs, you can gain valuable insights into the effectiveness of the strategies implemented and drive accountability within your organisation.

Continuous Improvement Strategies

Continuous improvement strategies are about embedding a culture of compliance within your organisation. With a focus on regular training, feedback loops, and updates to policies, you position your practice to adapt proactively to changing regulations. This not only ensures consistent compliance but also enables you to refine your processes for better efficiency.

Understanding the need for continuous improvement in compliance is vital to your firm’s success. It begins with establishing robust feedback mechanisms that allow you to learn from past experiences and adapt your practices accordingly. By routinely assessing your compliance methods and integrating updates, you foster a dynamic environment that supports both compliance and performance. This approach safeguards your firm from potential regulatory pitfalls and promotes a sustainable culture of excellence.

Summing up

As a reminder, understanding the importance of Compliance Consultant is imperative for your role as a COLP or COFA. These professionals not only help you navigate the complex regulatory landscape but also ensure that your firm remains aligned with industry standards. By following the eight steps outlined, you can enhance your understanding and effectively engage with Compliance Consultant, ultimately leading to better governance and a more robust practice. Prioritising these relationships will serve to strengthen your compliance framework and foster greater confidence in your operations.

FAQ

Q: What is the role of Compliance Consultant for COLPs and COFAs?

A: Compliance Consultant provide expert guidance to COLPs (Compliance Officers for Legal Practice) and COFAs (Compliance Officers for Finance and Administration) in ensuring adherence to legal regulations and best practices. They assess current compliance frameworks, identify potential risks, and implement effective strategies that align with regulatory requirements, thereby enhancing the overall compliance culture within the organisation.

Q: How can Compliance Consultant assist in risk management for legal practices?

A: Compliance Consultant play a vital role in risk management by conducting comprehensive audits and assessments of existing practices. They help COLPs and COFAs to identify areas of vulnerability, develop tailored risk mitigation strategies, and ensure that the firm’s policies are updated to reflect the latest regulatory changes. This proactive approach not only safeguards the firm’s reputation but also minimises the potential for costly penalties.

Q: What are the benefits of hiring Compliance Consultant as opposed to managing compliance in-house?

A: Engaging Compliance Consultant offers a wealth of benefits, including access to specialised expertise and knowledge of the latest legal developments. Since consultants focus exclusively on compliance, they can provide an objective assessment of existing practices and offer innovative solutions that may not be readily apparent to in-house staff. This approach can ultimately lead to more efficient compliance processes and a reduction in potential liabilities.

Q: How can Compliance Consultant help in training and development for team members?

A: Compliance Consultant can facilitate training programmes tailored to the specific needs of a firm. These programmes are designed to enhance the knowledge of team members regarding compliance regulations and ethical practices. By incorporating real-world scenarios and interactive elements, consultants ensure that staff are well-prepared to identify and address compliance issues. This investment in training leads to a more informed workforce capable of maintaining high standards of compliance.

Q: What should a legal practice look for when selecting Compliance Consultant?

A: When choosing Compliance Consultant, legal practices should consider several key factors, including the consultant’s experience within the legal sector, their understanding of relevant regulations, and their track record in implementing successful compliance strategies. Additionally, effective communication skills and the ability to provide bespoke solutions are important qualities. A thorough vetting process can help ensure that the selected consultant will effectively meet the specific needs of the practice.

To Contact Us

Tel; UK 0800 689 0190, International +44 207 097 1434

Email: info@complianceconsultant.org

Or Book A Discovery Call with us by clicking the picture below!

You may also be interested in;

The Compliance Consultant Advantage – 10 Strong Reasons Every COLP And COFA Should Consider

10 Steps To Understand Why A Specialist Compliance Consultant Can Help COLPs And COFAs

Why A Specialist Compliance Consultant Is Your Best Ally – 7 Steps For COLPs And COFAs

Unlocking Efficiency – How A Compliance Consultant Supports COLPs And COFAs In 5 Steps

10 Steps To Understand Why A Specialist Compliance Consultant Can Help COLPs And COFAs

5 Proactive Steps – How Compliance Consultants Empower COLPs And COFAs

Why Every COLP And COFA Needs A Compliance Consultant – 9 Steps For Success

Why Every COLP And COFA Needs A Compliance Consultant – 7 Key Benefits