Just as your firm navigates the complexities of compliance, understanding the benefits of engaging Compliance Consultant can be a game-changer for you as a COLP or COFA. This post will outline ten compelling reasons why employing a specialised consultant can not only streamline your processes but also enhance your firm’s reputation and increase client trust. With the right support, you can mitigate risks and focus on what you do best: providing top-notch legal services.

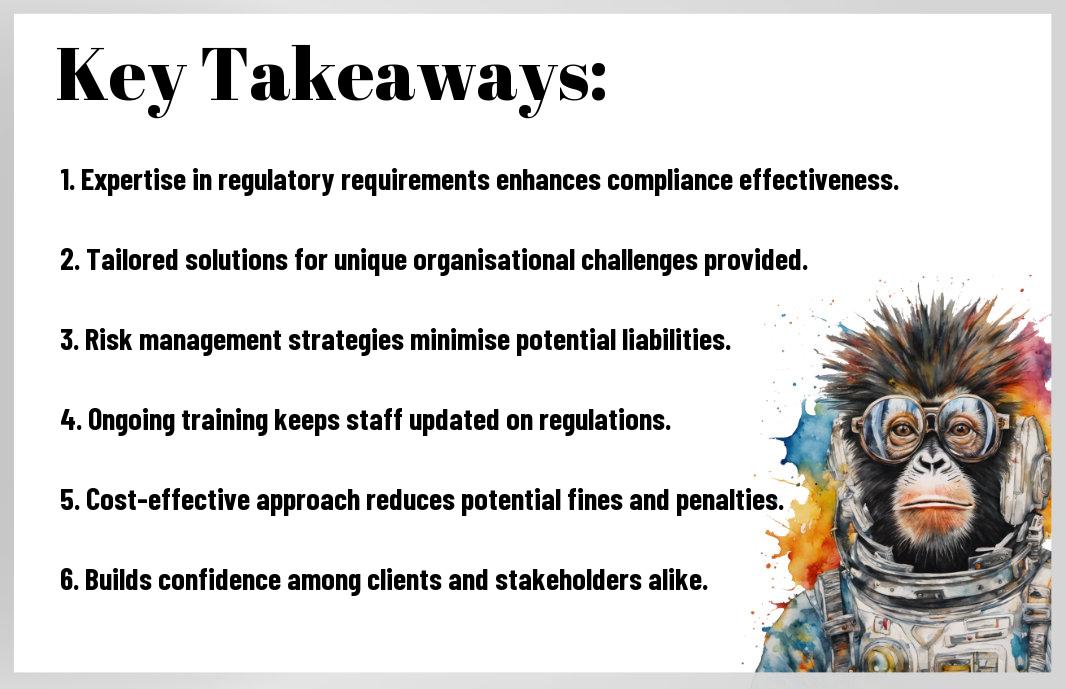

Key Takeaways:

-

Understanding the vital role of Compliance Consultant can enhance the effectiveness of COLPs and COFAs in managing regulatory requirements.

-

Compliance Consultant provide bespoke solutions that are tailored to the specific needs and challenges faced by legal practices.

-

Utilising Compliance Consultant can lead to improved risk management and operational efficiency within a firm.

-

Engaging with Compliance Consultant can offer access to the latest industry insights and best practices, keeping firms ahead of regulatory changes.

-

Compliance Consultant can provide valuable training and support for staff, fostering a culture of compliance throughout the organisation.

Expertise in Regulations

Compliance Consultant possesses profound knowledge of the constantly evolving regulations within your industry. This expertise helps ensure you meet all legal obligations while effectively minimising potential risks and compliance pitfalls.

In-depth industry knowledge

Even seasoned COLPs and COFAs can benefit from Compliance Consultant’s extensive understanding of industry-specific regulations. Their insights into the latest developments allow you to stay ahead of potential compliance challenges.

Tailored compliance strategies

The beauty of engaging Compliance Consultant lies in their ability to create customised compliance solutions that address your unique challenges. This personalised approach enhances your compliance framework, catering to the specific needs of your firm.

Plus, by analysing your firm’s particular circumstances and operational nuances, Compliance Consultant can develop robust strategies that not only enhance compliance but also support your overall business goals. These tailored solutions help you manage risks effectively, ensuring you remain within the protective boundaries of the law while fostering a culture of integrity and accountability within your organisation.

Risk Mitigation

Any organisation can face potential risks that may lead to significant liabilities. By partnering with Compliance Consultant, you can develop a robust framework that not only addresses existing vulnerabilities but also anticipates future challenges. This proactive approach can safeguard your firm against legal issues, financial losses, and reputational damage, ensuring that you remain compliant with industry regulations.

Identifying Potential Liabilities

Even minor oversights can lead to serious liabilities for your organisation. Compliance Consultant can help you pinpoint weaknesses in your current systems and processes, allowing you to address these gaps proactively. Recognising potential legal pitfalls is the first step in ensuring that your firm operates within the framework of the law.

Building Protective Measures

If you want to shield your firm from potential claims, implementing protective measures is imperative. Compliance Consultantt will work with you to design and enforce strategies to mitigate risks, ensuring your operations adhere to relevant regulations and standards.

For instance, a consultant might help you establish clear internal policies and conduct regular training sessions for your staff to ensure everyone understands compliance requirements. By implementing robust reporting mechanisms, you can swiftly identify and rectify any issues that arise. This proactive strategy not only reduces your risk exposure but also cultivates a culture of compliance within your organisation, effectively protecting your brand and assets.

Increased Efficiency

Not having Compliance Consultant can lead to fragmented processes that cost your firm time and resources. By engaging with Compliance Consultant, you can maximise your firm’s efficiency with their specialised knowledge and insights. For more on the significance of robust practices, read Why Strong Compliance Still Matters So Much.

Streamlining Processes

There’s a distinct advantage to having professional guidance; it enables you to streamline your compliance processes effectively. This leads to a more cohesive approach to your regulatory obligations, allowing you to focus on core business functions.

Reducing Regulatory Burdens

Any regulatory burden can be overwhelming, but a Compliance Consultant helps alleviate this pressure. You’ll find that they enable sustainable practices, helping you navigate complex regulations with ease.

Processes that once seemed daunting can be simplified through Compliance Consultant’s expertise. They help you avoid expensive fines by ensuring your compliance practices align with current regulations, ultimately enhancing your firm’s reputation. Moreover, by identifying inefficiencies in your current systems, a consultant can propose changes that not only protect your business but also contribute to greater financial savings. With their assistance, you will be equipped to manage regulatory requirements and focus on growth opportunities.

Enhanced Reputation

Keep your firm’s reputation at the forefront by engaging Compliance Consultant. By doing so, you can ensure adherence to regulatory standards, which will enhance your credibility in the legal sector. Clients and peers alike will recognise your commitment to compliance, leading to greater investor confidence and a superior standing in the market.

Building client trust

Reputation plays a pivotal role in building client trust. When you utilise the expertise of Compliance Consultant, you demonstrate a dedicated effort to uphold the highest standards of service and ethical practice. This transparency reassures clients, fostering long-term relationships and encouraging referrals.

Strengthening brand image

To reinforce your firm’s brand image, partnering with Compliance Consultant can be significantly beneficial. By promoting operational excellence and ethical standards, you set your firm apart, making it a go-to choice for clients seeking reliability.

Any firm that embraces compliance consulting will find enhanced visibility, as a strong compliance record not only attracts potential clients but also solidifies your firm’s standing within the industry. Investing in compliance helps you communicate values of integrity and responsibility, leading to improved client loyalty. Furthermore, a solid brand image can deter negative perceptions and potential crises. In today’s competitive market, a well-respected brand not only draws in clients but also encourages partnerships and collaborations, crucial for long-term success.

Training and Development

Now, by engaging a Compliance Consultant, you gain access to tailored training and development programmes designed specifically for your firm’s unique needs. This ensures that you and your team acquire the necessary skills to navigate complex compliance landscapes and foster a culture of adherence within your organisation.

Staff Compliance Training

Training is vital for equipping your staff with the knowledge and skills needed to meet compliance requirements effectively. Compliance Consultant can deliver engaging and interactive sessions, helping to ensure that all team members are up to date with legislative changes and best practices. This proactive approach not only mitigates risks but also enhances overall firm performance.

Continuous Professional Growth

Assuming you prioritise continuous professional growth, Compliance Consultant can offer tailored support to help you and your team stay ahead in an evolving regulatory landscape.

This ongoing development is vital for maintaining your competitive edge in the legal sector. By investing in training and updates, your team can adapt to changing regulations, enhancing your firm’s ability to meet compliance standards. Moreover, a commitment to continuous learning fosters a culture of excellence and accountability, ultimately leading to improved client trust and satisfaction. With professional growth, you’re not only minimising risks but also enhancing your firm’s reputation as a leader in compliance.

Cost-Effectiveness

Despite common misconceptions, engaging Compliance Consultant can be a highly cost-effective strategy for your firm. By integrating expert guidance, you can reduce potential legal costs and avoid financial penalties that arise from compliance failures. This investment not only protects your firm’s finances but also ensures you’re utilising your resources in a more efficient manner, thereby enhancing overall profitability.

Minimizing penalties

You should recognise that hiring Compliance Consultant can significantly help in minimising potential penalties. With their expert knowledge, they can spot compliance gaps early and implement corrective measures, which reduces the risk of costly fines and legal repercussions that could otherwise impact your firm’s reputation and financial health.

Optimizing resource allocation

With Compliance Consultant, you can streamline your processes and ensure that you are directing your resources where they are most needed. This enables you to achieve greater efficiency and effectiveness in your operations, making the most of your workforce and financial resources.

Minimising inefficiencies can lead to substantial savings in operational costs, allowing you to allocate funds to areas that drive value for your firm. By assessing your current practices and identifying vulnerabilities, Compliance Consultant can provide you with tailored strategies that not only streamline your compliance procedures but also improve overall operational performance. This proactive approach ensures that your resources are not wasted and that your firm is positioned for sustainable growth.

Navigating Changes

Many organisations face constant changes in regulations and practices, which can be challenging to manage effectively. Compliance Consultant’s role includes guiding COLPs and COFAs through this complex landscape, ensuring they remain compliant and minimise risks associated with non-compliance. Your expertise can streamline the process, allowing your clients to adapt quickly and efficiently to new developments.

Adapting to new laws

Some changes in legislation can significantly impact compliance requirements for law firms. You must stay well-informed about these updates, promoting a culture of adaptability within the organisation. This proactive approach allows you and your clients to mitigate risks and ensure that all practices align with current legal standards.

Proactive change management

You’ll benefit from adopting a proactive change management strategy that identifies potential issues before they escalate. This foresight enables timely adjustments while maintaining compliance across all areas of your organisation.

You can establish a strong framework for proactive change management by implementing regular assessments of your compliance policies and procedures. Engaging in continuous training for your staff will ensure they are equipped to handle changes effectively. Creating a robust communication plan enhances awareness of impending changes and their implications. This will foster a culture of adaptability and responsiveness, allowing your organisation to navigate any challenges with confidence while upholding compliance standards.

Focus on Core Business

After engaging Compliance Consultant, you can shift your attention back to your core business operations. By outsourcing compliance responsibilities, you can dedicate your time and resources to growing your firm, maximising client satisfaction, and optimising your service delivery. Letting specialists handle complex compliance matters frees you from the burden and allows you to enhance your overall business effectiveness.

Reducing Distractions

While compliance is necessary, it often leads to unnecessary distractions from your primary objectives. By delegating these responsibilities to a consultant, you can minimise interruptions caused by regulatory updates, audits, and procedural changes. This allows you to concentrate on what you do best, running your business efficiently.

Enhancing Operational Focus

Clearly, Compliance Consultant helps you achieve a sharper operational focus. With their expertise, you can streamline processes, ensuring that compliance is integrated into your daily operations without overwhelming your team. This permits you to maintain a clear vision for your business while remaining compliant with regulations.

Focus on the benefits of a consultancy partnership, as it allows you to prioritise key business activities. By trusting compliance specialists, you ensure that your firm adheres to industry regulations, which mitigates the risk of substantial penalties or reputational damage. This balance enables you to concentrate on innovation, customer engagement, and overall business growth, leaving compliance details to the experts.

Partnership Opportunities

Your journey towards enhanced compliance does not have to be a solitary one. By employing Compliance Consultant, you can forge valuable partnerships that expand your resources, skills, and knowledge base. These collaborative relationships can significantly enhance your capacity to navigate complex regulatory requirements and develop more effective compliance strategies.

Networking with Experts

You have the opportunity to connect with seasoned professionals who possess a wealth of knowledge and experience in compliance. Engaging with these experts can provide you with insights that are not readily available through traditional training or literature, enabling you to stay ahead in the ever-evolving regulatory landscape.

Collaborative Solutions

With Compliance Consultant, you can access tailored solutions that leverage industry best practices. Their external perspective can help identify gaps in your current processes, ensuring that your compliance framework is not only effective but also adaptable.

To maximise your compliance efforts, your consultant will work closely with you to develop tailored strategies that consider your specific circumstances and challenges. This partnership allows for the integration of innovative technologies and methodologies that streamline compliance processes. By pooling resources and expertise, you can create a more robust compliance programme, significantly reducing the risks associated with regulatory failures. The ability to brainstorm together fosters a dynamic and proactive approach to compliance, ensuring you are prepared for the unexpected in an ever-changing legal environment.

Access to Resources

Unlike working in isolation, engaging Compliance Consultant grants you access to a wealth of resources. These professionals have extensive networks and databases that can significantly improve your understanding of compliance regulations. You can leverage these resources to enhance your knowledge base and ensure your firm remains compliant in an ever-evolving legal landscape.

Comprehensive tools

Tools provided by Compliance Consultant can streamline your processes and incorporate best practices. They come equipped with a range of software and systems designed to help you handle compliance efficiently, thus reducing your workload and minimising the risk of errors.

Latest compliance insights

Now, staying updated with the latest compliance insights is paramount to your role. Engaging with Compliance Consultant allows you to receive timely notifications about changes in regulations, which could otherwise pose significant risks to your firm.

You can access valuable insights that highlight emerging trends and potential changes in legislation that could impact your firm. This proactive approach empowers you to adapt quickly, ensuring that you are always one step ahead of potential compliance issues. By tapping into this stream of knowledge, you effectively safeguard your firm’s operations against possible penalties or reputational damage stemming from non-compliance.

To wrap up

Upon reflecting on the ten strong reasons for every COLP and COFA to consider the advantages of Compliance Consultant, it becomes clear how invaluable their expertise can be. You stand to benefit significantly from tailored guidance that not only enhances your compliance practices but also mitigates potential risks to your firm. Engaging with Compliance Consultant empowers you to stay ahead of regulatory changes while maintaining operational efficiency, allowing you to focus on your core responsibilities. Embracing this partnership could ultimately lead to a more secure and compliant environment for your organisation.

FAQ

Q: What is the ‘Compliance Consultant Advantage’?

A: The ‘Compliance Consultant Advantage’ refers to the benefits that Compliance Consultant offer to COLPs (Compliance Officers for Legal Practice) and COFAs (Compliance Officers for Finance and Administration) in ensuring that legal practices meet regulatory requirements and best practices. This guidance can enhance operational efficiency and reduce risks associated with non-compliance.

Q: Why should COLPs and COFAs consider hiring Compliance Consultant?

A: Hiring Compliance Consultant can provide COLPs and COFAs with expert insight into the latest regulatory changes and industry standards. Consultants can assist in developing effective compliance strategies, conducting regular audits, and providing training for staff, ultimately leading to more robust compliance frameworks.

Q: What are the top advantages of engaging Compliance Consultant?

A: There are several advantages to hiring Compliance Consultant, including specialised knowledge, an objective viewpoint, efficient resource management, access to updated tools and frameworks, and ongoing support. These factors collectively contribute to a more comprehensive compliance approach that can protect firms from potential pitfalls.

Q: How can Compliance Consultant aid in training staff members?

A: Compliance Consultant often offer tailored training programmes to educate staff on compliance practices and regulatory requirements. They can create engaging learning materials, facilitate workshops, and provide ongoing support, ensuring that all personnel understand their roles in maintaining compliance within the firm.

Q: What should COLPs and COFAs look for when selecting Compliance Consultant?

A: When deciding on Compliance Consultant, COLPs and COFAs should consider the consultant’s experience in the legal sector, their knowledge of relevant regulations, their reputation among peers, and the range of services they offer. Additionally, it is beneficial to assess their approach to communication and training, as these will impact the overall effectiveness of the compliance programme.

To Contact Us

Tel; UK 0800 689 0190, International +44 207 097 1434

Email: info@complianceconsultant.org

Or Book A Discovery Call with us by clicking the picture below!

You may also be interested in

10 Steps To Understand Why A Specialist Compliance Consultant Can Help COLPs And COFAs