Compliance is an important aspect of running a successful legal practice, ensuring that you meet all regulatory requirements while safeguarding your firm’s reputation. By partnering with Compliance Consultant, you can elevate your compliance standards, paving the way for increased efficiency and reduced risk. This guide outlines 10 vital steps to help you harness the expertise of a consultant, particularly if you are a COLP or COFA, to enhance your compliance strategies and effectively navigate the complex landscape of legal regulations.

Compliance is an important aspect of running a successful legal practice, ensuring that you meet all regulatory requirements while safeguarding your firm’s reputation. By partnering with Compliance Consultant, you can elevate your compliance standards, paving the way for increased efficiency and reduced risk. This guide outlines 10 vital steps to help you harness the expertise of a consultant, particularly if you are a COLP or COFA, to enhance your compliance strategies and effectively navigate the complex landscape of legal regulations.

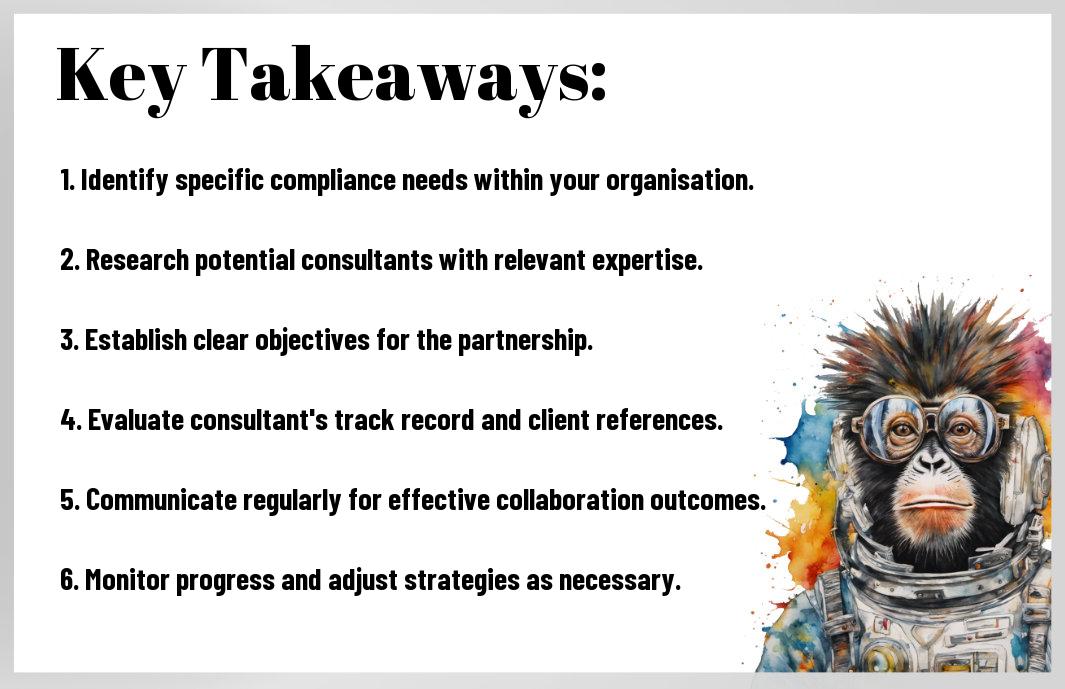

Key Takeaways:

-

Partnering with Compliance Consultant can enhance the effectiveness of COLPs and COFAs in ensuring legal and regulatory adherence.

-

Assessing the specific needs of your organisation is vital before selecting Compliance Consultant to ensure a tailored approach.

-

Effective communication and collaboration with Compliance Consultant can lead to the development of more robust compliance frameworks.

-

Regular training and updates from the consultant are vital to keep staff informed about compliance changes and best practices.

-

Continuous evaluation of compliance processes is needed to foster improvement and adapt to changing regulations.

Define Compliance Requirements

While navigating the complex landscape of compliance, it is imperative for you to define your specific requirements clearly. This helps to ensure that your firm operates within the legal frameworks and adheres to the ethical standards set forth by regulatory bodies. Engaging with Compliance Consultant can help you articulate these needs effectively and develop a roadmap tailored to your organisation’s objectives.

Identify Legal Obligations

To establish your compliance framework, you must first identify your legal obligations. This involves conducting a thorough assessment of the laws and regulations that apply to your practice, including those specific to your area of law and any general compliance mandates that impact your operations.

Understand Industry Standards

On the path to compliance, it is vital that you understand industry standards that govern your practice. These standards often dictate best practices and provide benchmarks that can guide your compliance efforts. Staying informed about these expectations not only protects your firm but also enhances your credibility with clients and regulators alike.

A comprehensive grasp of industry standards is necessary for ensuring that you meet the expectations set by professional bodies as well as avoiding potential legal pitfalls. Engaging with your compliance consultant can provide insights into emerging trends and regulations, enabling you to stay ahead of the curve. By aligning your operations with these standards, you are not only safeguarding your practice but also instilling confidence in your clients, which can greatly enhance your firm’s reputation and client trust.

Assess Current Practices

Clearly, assessing your current compliance practices is vital for identifying gaps and deficiencies. This foundational step enables you to understand how well your organisation aligns with legal and regulatory requirements. By evaluating your existing processes, you can pinpoint areas that require improvement and ensure that you’re equipped to meet your compliance objectives effectively.

Evaluate Existing Policies

Little attention is often given to reviewing existing policies, yet it’s a fundamental aspect of compliance management. Ensuring that your policies are up-to-date and relevant can significantly mitigate risks and enhance your compliance efforts.

Conduct Risk Assessment

Policies should undergo regular risk assessments to gauge their effectiveness and identify potential vulnerabilities. This involves systematically analysing your processes to uncover areas that may pose legal or operational risks. The outcome of a thorough risk assessment will provide you with a clear understanding of your compliance landscape and help you prioritise remediation efforts. By highlighting high-risk areas and addressing them promptly, you contribute to a more robust compliance framework, safeguarding your organisation from potential liabilities and enhancing your overall operational integrity.

Research Potential Consultants

Once again, thorough research is crucial when seeking Compliance Consultant. Start by identifying consultants with a strong reputation in your field. Look for those who specialise in the regulatory landscape specific to COLPs and COFAs. Make use of online reviews, industry forums, and personal recommendations to compile a list of potential candidates. Take the time to understand each consultant’s approach to compliance and how it aligns with your firm’s values and objectives.

Check Qualifications

You should verify the qualifications of any compliance consultant on your shortlist. Look for formal accreditations, relevant experience in legal compliance, and memberships in professional associations. A well-qualified consultant can demonstrate a robust understanding of the compliance framework, which is vital for achieving your objectives.

Review Past Performance

The performance history of Compliance Consultant is a significant indicator of their ability to deliver results. Evaluate their track record by asking for case studies or references that showcase their previous work with similar organisations. This information will help you gauge their effectiveness and reliability in helping firms like yours meet regulatory standards.

This requirement to review past performance not only aids in assessing a consultant’s capability but also highlights their experience in overcoming challenges. Look out for examples of successful compliance implementations and instances where they effectively managed risk within a firm’s operations. A consultant with a strong portfolio demonstrates their adaptability and strategic strengths, which can greatly enhance your compliance framework. Be vigilant for any red flags in their past dealings; consistent failures or unresolved disputes may signal potential issues you would rather avoid in your partnership.

Set Clear Expectations

Your journey towards enhanced compliance begins with setting clear expectations. Clearly articulating your needs and objectives ensures that both you and your compliance consultant are aligned. Establishing mutual understanding not only fosters a productive partnership but also guarantees that your compliance strategies are tailored to address your specific challenges and ambitions.

Define Goals

If you want to achieve effective results, you must define your goals with precision. Consider what specific compliance challenges you’re facing and outline measurable objectives to address them. This clarity will guide your partnership, enabling the consultant to provide targeted advice and implement strategies that truly resonate with your operational needs.

Establish Timelines

Assuming you want to keep your project on track, establishing timelines is imperative for monitoring progress. Agreeing on a timeline not only helps you manage expectations but also ensures that both you and your consultant are held accountable for milestones and outcomes.

This structured approach allows you to stay focused on key deadlines and means you’ll be better equipped to make necessary adjustments along the way. By having a clear timeline, you can establish continuous check-ins to review progress and address any unforeseen challenges promptly. This enhances your ability to maintain compliance standards effectively, ensuring that you meet important regulatory requirements without unnecessary delays.

Engage in Consultation

Unlike the assumption that compliance can be handled independently, partnering with Compliance Consultant requires active engagement and collaboration. Establishing a rapport with your consultant will not only facilitate a smoother experience but will also reinforce the importance of adhering to regulatory standards. By embracing open communication, you’ll find it easier to navigate the complexities of compliance and ensure your organisation meets all necessary requirements.

Schedule Initial Meetings

Any successful relationship begins with a well-planned initial meeting. This is your opportunity to outline your expectations, discuss timelines, and establish a foundation of trust with your compliance consultant. Take the time to prepare an agenda that addresses the key points you would like to cover, ensuring that the meeting is both productive and informative.

Discuss Compliance Needs

Compliance needs typically vary from one organisation to another, which is why open dialogue is necessary during your consultation. By discussing your specific compliance requirements, you’re setting the stage for a tailored approach that addresses potential risks and regulatory obligations. This discussion should encompass your current compliance landscape, any challenges you face, and your long-term objectives.

Consultation sessions dedicated to discussing compliance needs allow for a detailed examination of your business environment and specific regulations that impact your operations. Your consultant will assess specific areas of concern while identifying potential gaps in your current strategy. This collaborative analysis ensures that your compliance requirements are accurately represented, enabling your consultant to develop a comprehensive plan tailored to your business. Open and honest discussion will lead to a more robust compliance framework and stronger organisational stability.

Evaluate proposals

For your compliance needs, evaluating proposals is a significant step. Carefully assess the services offered, costs involved, and the expertise of each compliance consultant. This will help you determine which proposal aligns best with your firm’s objectives and budget. Engaging in this thorough evaluation will ensure you partner with the right consultant to enhance your compliance standards effectively.

Compare services offered

On assessing the proposals, create a table to compare the services provided by each consultant. This will help visualise the differences and identify the best fit for your requirements.

| Consultant Name | Services Offered |

|---|---|

| Consultant A | Compliance training, risk assessment, policy development |

| Consultant B | Audit support, monitoring, compliance strategy |

| Consultant C | Policy updates, training sessions, regulatory advice |

Analyse costs involved

Analyse the costs involved in each proposal to ensure that you are making an informed decision.

The overall costs of compliance consultancy can vary dramatically based on the services provided and the consultant’s experience. Be wary of hidden fees or unexpected expenses that may not be clearly outlined in the proposals. Consider the long-term value each consultant offers; investing more initially could lead to greater compliance success and potentially save your firm from costly penalties later. By carefully analysing these factors, you can choose a consultant that not only fits within your budget but also meets your compliance needs effectively.

Negotiate Terms

Keep in mind that negotiating terms with your compliance consultant is necessary to ensuring both parties are clear about expectations and requirements. Establish a mutual understanding of the project scope, timeline, and communication protocols to foster a productive partnership that meets your compliance goals.

Clarify Deliverables

Negotiate the specific deliverables that the compliance consultant will provide during the engagement. Clearly define the outcomes you expect, including reports, training sessions, or policy updates. This clarity will prevent misunderstandings and ensure that the consultant’s output aligns with your organisational needs.

Agree on Pricing

An important aspect of the negotiation process is agreeing on pricing for the consultant’s services. Ensure that you have a comprehensive understanding of the consultant’s fee structure, including any potential additional costs or services.

Plus, it’s vital to consider how the fee structure aligns with your budget. Ensure you are aware of fixed fees versus hourly rates and whether there are contingency fees for specific outcomes. By asking for a detailed breakdown and understanding payment schedules, you can effectively manage your finances while ensuring that you receive the necessary expertise to elevate your compliance standards.

Monitor Progress

Despite the best intentions, compliance initiatives can stall without proper monitoring. Therefore, it’s imperative to regularly assess your progress towards compliance goals. Utilise resources such as 10 Key Steps for New Chief Compliance Officers – Guide to establish a framework for monitoring your progress effectively.

Track Milestones

On your journey towards compliance, tracking milestones plays a significant role in providing a clear pathway. Set specific, measurable objectives that denote progress, enabling you to celebrate achievements and identify areas that require further attention.

Adjust Strategies as Needed

With ongoing monitoring, you may find a need to adapt your strategies to better meet compliance requirements. Ignoring shifts in regulations or organisational needs can lead to failures in compliance.

You can ensure your compliance efforts remain effective by maintaining flexibility in your strategies. Regularly review your compliance framework to identify gaps and inefficiencies. This allows you to make real-time adjustments, ensuring your approach is always aligned with the latest regulations and best practices. Engaging your consultants during these reviews can provide valuable insights and prevent potential risks that may arise from outdated strategies.

Maintain Ongoing Support

Many organisations overlook the significance of ongoing support when working with Compliance Consultant. Establishing a continuous relationship ensures that you have access to expert guidance as regulations evolve and your firm’s needs change. This not only helps you stay ahead of compliance issues but also fosters a culture of accountability and safety within your organisation.

Schedule Regular Check-Ins

You should aim to schedule regular check-ins with your compliance consultant. These meetings provide an opportunity to discuss progress, address any challenges, and adapt strategies as necessary, ensuring that your compliance framework remains robust and attuned to your firm’s specific requirements.

Update Compliance as Necessary

Regular updates to your compliance protocols are vital in a dynamic regulatory environment. The landscape of compliance is constantly shifting, with new regulations and guidelines emerging frequently. By actively revisiting and updating your compliance measures, you effectively mitigate risks associated with non-compliance and ensure your firm remains aligned with industry standards. This proactive approach guarantees that your compliance framework is not only up to date but also resilient enough to withstand changes, safeguarding your firm’s reputation and integrity.

To wrap up

Ultimately, by following these ten steps to partner with Compliance Consultant for COLPs and COFAs, you can significantly enhance your compliance standards. Engaging with a knowledgeable consultant not only streamlines your compliance processes but also fortifies your firm’s reputation and reduces the risk of non-compliance. By actively participating in this partnership, you enable your practice to adapt to evolving regulations and maintain a proactive stance in today’s dynamic legal environment.

FAQ

Q: What is the role of Compliance Consultant for COLPs and COFAs?

A: Compliance Consultant serves to guide Compliance Officers for Legal Practices (COLPs) and Compliance Officers for Finance and Administration (COFAs) in adhering to regulatory requirements. They provide expertise in identifying potential risks, developing policies, and establishing best practices tailored to the specific needs of legal and financial firms. Their role is to ensure that these professionals can effectively manage compliance whilst minimising the likelihood of regulatory breaches.

Q: How do I choose the right compliance consultant?

A: Selecting the appropriate compliance consultant involves assessing their experience, qualifications, and track record in your particular sector. It is advisable to look for consultants who have a strong understanding of the legal and financial compliance landscape and can demonstrate their ability to handle past challenges. Additionally, seeking recommendations and reviewing client testimonials can help in evaluating their suitability.

Q: What should I expect during the initial consultation with Compliance Consultant?

A: During the initial consultation, you can expect the consultant to conduct a thorough assessment of your current compliance status. They will likely ask probing questions about your practices, policies, and any existing issues you have encountered. This meeting is an opportunity for you to articulate your objectives and concerns, enabling the consultant to tailor their approach to meet your specific compliance needs.

Q: How long does it typically take to implement a compliance programme with a consultant?

A: The timeline for implementing a compliance programme can vary based on several factors, including the size of your organisation, the complexity of your compliance obligations, and the existing framework in place. Generally, a comprehensive programme might take anywhere from a few weeks to several months to develop and implement fully. The consultant will work with you to create a realistic timeline that aligns with your organisational goals.

Q: What ongoing support can I expect from Compliance Consultant after programme implementation?

A: Post-implementation, many compliance consultants offer ongoing support that may include training sessions for staff, regular compliance audits, updates on regulatory changes, and adjustments to policies as required. This continuous relationship is vital to ensuring that the compliance programme remains effective and evolves alongside industry developments and emerging risks.

To Contact Us

Tel; UK 0800 689 0190, International +44 207 097 1434

Email: info@complianceconsultant.org

Or Book A Discovery Call with us by clicking the picture below!

You may also be interested in

The Compliance Consultant Advantage – 10 Strong Reasons Every COLP And COFA Should Consider

10 Steps To Understand Why A Specialist Compliance Consultant Can Help COLPs And COFAs

Why A Specialist Compliance Consultant Is Your Best Ally – 7 Steps For COLPs And COFAs

Compliance is an important aspect of running a successful legal practice, ensuring that you meet all regulatory requirements while safeguarding your firm’s reputation. By partnering with

Compliance is an important aspect of running a successful legal practice, ensuring that you meet all regulatory requirements while safeguarding your firm’s reputation. By partnering with