Introduction

The Financial Conduct Authority (FCA) plays a crucial role in regulating financial services in the UK to protect consumers and ensure market integrity. Effective compliance with FCA standards is essential for businesses operating in this sector. This article outlines the steps for implementing the FCA compliance framework in your business, emphasising the importance of a structured approach to regulatory compliance.

- Understanding FCA Regulations

1.1 Key FCA Regulations

Understanding the core FCA regulations is the first step in compliance. Key regulations include the FCA Handbook, which covers rules regarding conduct of business, prudential standards, and consumer protection. Familiarising yourself with these will help you identify the specific requirements that apply to your business model.

1.2 Importance of Compliance

Compliance is not just about avoiding penalties; it’s integral for risk management and protecting customers. A robust compliance framework enhances business integrity, builds trust with stakeholders, and ensures sustainability.

- Assessing Your Current Compliance Status

2.1 Conducting a Compliance Audit

Start by conducting a thorough compliance audit. This process involves reviewing existing policies, procedures, and controls to assess their effectiveness. Identify any gaps in compliance with FCA regulations and document your findings to inform future improvements.

2.2 Risk Assessment

Implement a risk assessment that identifies potential vulnerabilities in your operations. Utilise methodologies such as SWOT analysis or risk matrices to prioritise the risks based on their likelihood and impact. This helps focus compliance efforts effectively.

- Developing a Compliance Strategy

3.1 Setting Compliance Objectives

Define clear compliance objectives that align with your overall business strategy. These objectives should be specific, measurable, achievable, relevant, and time-bound (SMART). This structured approach facilitates tracking progress and ensures accountability.

3.2 Policy Development

Develop comprehensive compliance policies outlining the procedures for adherence to FCA regulations. Ensure these policies are communicated effectively across the organisation and regularly updated to reflect any changes in the regulatory landscape.

- Implementing Compliance Procedures

4.1 Staff Training and Development

Conduct regular training sessions for staff to educate them about relevant compliance issues and procedures. Training fosters awareness and empowers employees to act in compliance with FCA standards. Incorporate real-life scenarios for better engagement and understanding.

4.2 Monitoring and Reporting Systems

Establish monitoring and reporting systems to ensure compliance across all operational levels. These systems should include checks and balances, allowing for timely reporting of compliance issues. Develop internal controls that actively track adherence to established procedures.

- Maintaining Compliance Culture

5.1 Leadership and Accountability

Foster a culture of compliance by ensuring that leadership actively supports and prioritises compliance initiatives. Establish clear accountability frameworks where leaders are responsible for compliance outcomes within their teams.

5.2 Continuous Improvement

Adopt a philosophy of continuous improvement by regularly seeking feedback and reviewing compliance performance. Hold periodic compliance reviews to adapt your strategies in response to regulatory changes, internal audits, and market dynamics.

Conclusion

Implementing the FCA compliance framework is vital for safeguarding your business and maintaining consumer trust in the financial sector. By understanding regulations, assessing your current compliance status, developing effective strategies, and fostering a culture of compliance, you can navigate the complexities of financial regulation successfully. Take action today to ensure your business remains compliant and resilient in a rapidly evolving regulatory environment.

To Contact Us

Tel; UK 0800 689 0190, International +44 207 097 1434

Email: info@complianceconsultant.org

Or Book A Discovery Call with us by clicking the picture below!

You may also find these posts of interest

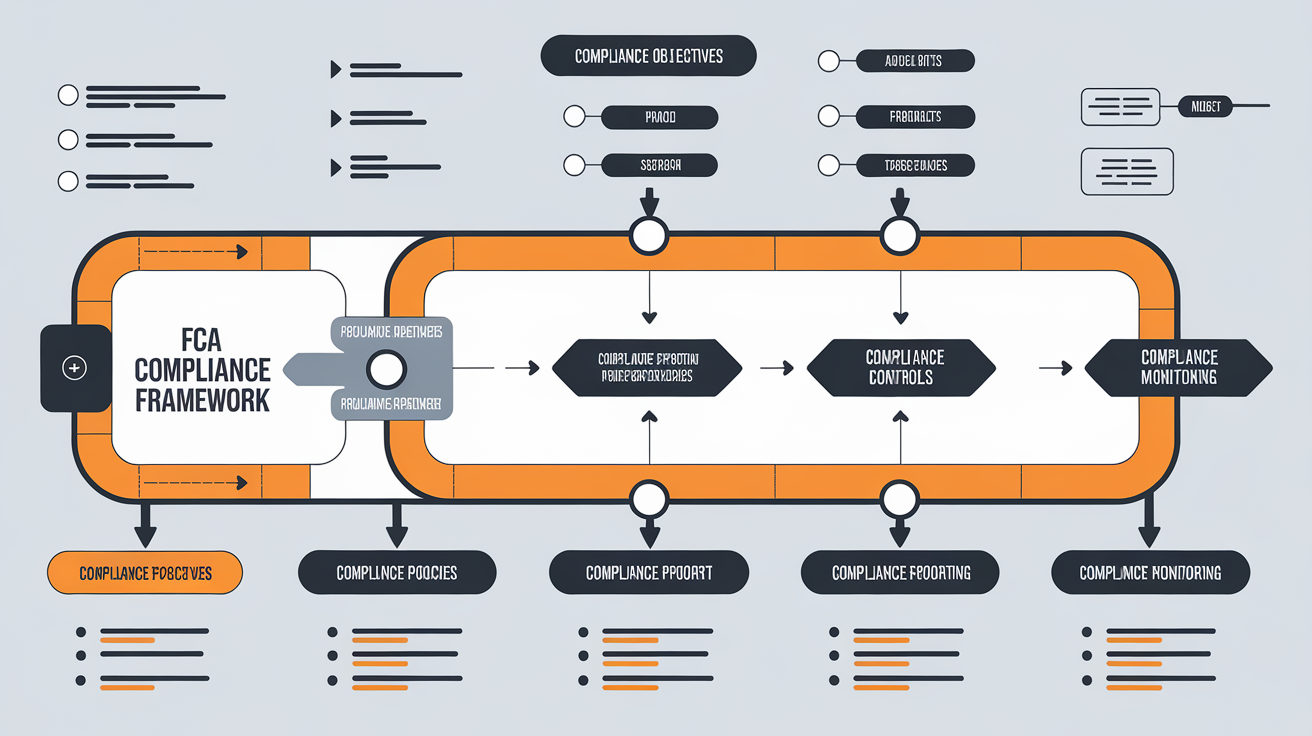

Components of the FCA Compliance Framework

Case Studies of Successful Implementation

Definition and Importance of FCA Compliance

Key FCA Regulations

Consequences of Non-Compliance