Introduction to FCA Compliance Framework

The Financial Conduct Authority (FCA) plays a pivotal role in ensuring that financial institutions in the UK operate within a structured compliance framework. This framework is designed to protect consumers, maintain market integrity, and promote competition. Understanding its components is essential for firms aiming to meet regulatory expectations and foster a culture of compliance.

Overview of the FCA

The FCA is the UK’s regulatory authority responsible for overseeing financial markets and firms. Established to protect consumers and uphold the integrity of the financial services industry, the FCA enforces compliance with regulations that govern how firms manage risk, treat customers, and operate transparently.

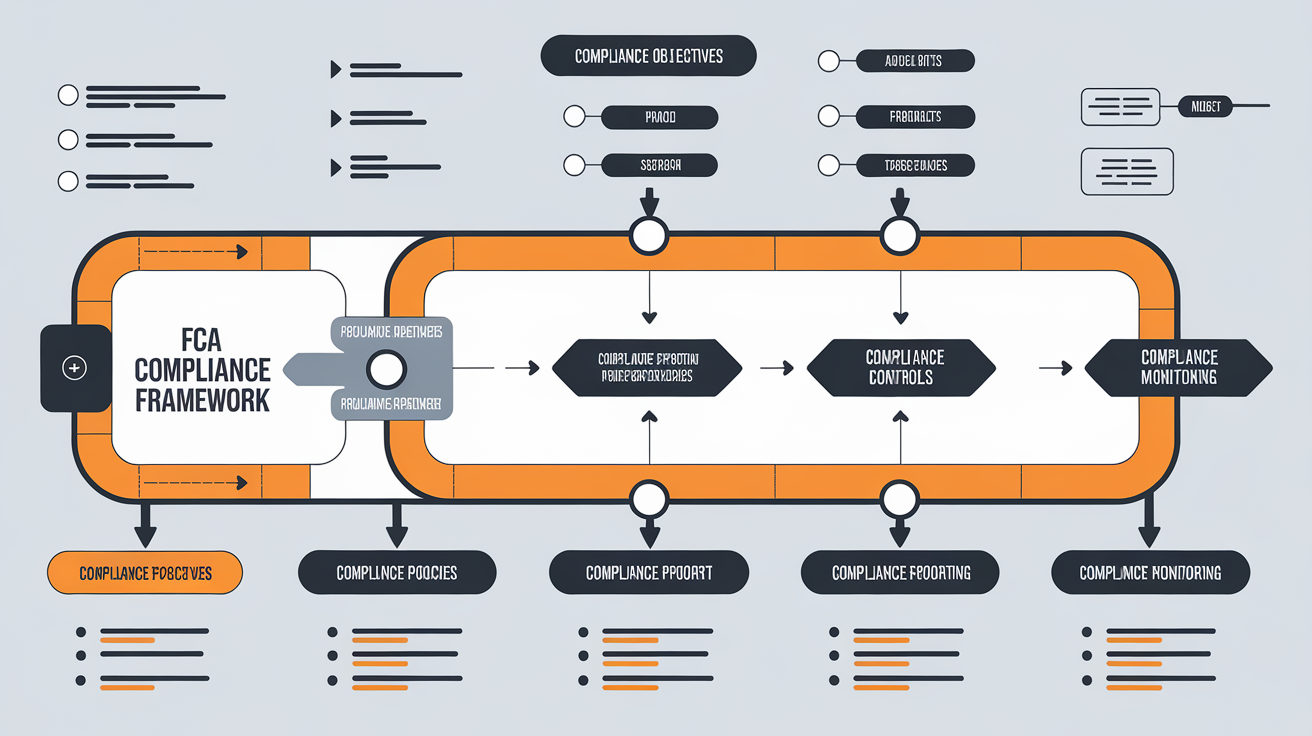

Key Components of FCA Compliance Framework

Governance and Oversight

A robust governance structure is crucial for effective compliance. The board of directors must ensure that there are proper controls and oversight mechanisms in place. Each member of the management team has specific responsibilities concerning compliance, making it essential to establish clear lines of authority and reporting.

Risk Management

Effective risk management involves identifying, assessing, and mitigating potential risks that could impact the organisation. Firms should develop a comprehensive risk framework that allows them to proactively address operational, financial, and regulatory risks. Regular reviews and updates to these frameworks ensure they remain relevant and effective.

Compliance Monitoring

Regular compliance monitoring is necessary for identifying any gaps in adherence to FCA regulations. This involves conducting internal audits to assess compliance levels and implementing changes as needed. Firms should maintain accurate records of regulatory reporting and audits to demonstrate compliance status consistently.

Training and Competence

To foster a culture of compliance, ongoing staff training is vital. Employees should be educated about the latest regulatory updates, compliance policies, and ethical standards. Training programs should be tailored to different roles within the organisation to ensure that all employees are competent and confident in their responsibilities regarding compliance.

Customer Outcomes

Fair treatment of customers is at the heart of FCA regulations. Firms must implement processes to ensure that customer needs are met and that feedback is regularly collected and addressed. By focusing on customer outcomes, firms can enhance trust and satisfaction while minimizing the risk of regulatory breaches.

Challenges in FCA Compliance

Firms often face numerous challenges in maintaining compliance with FCA regulations, including rapidly changing regulations and the complexities of operational risks. Developing agility within compliance processes and fostering a culture that embraces change can help firms navigate these hurdles effectively.

Best Practices for Effective FCA Compliance

To build a robust compliance framework, firms should adopt best practices such as proactive compliance measures, continuous improvement through feedback loops, and regular engagements with regulatory bodies. Establishing a compliance task force can enhance focus and drive continuous adherence to best practices.

Conclusion

The components of the FCA compliance framework are essential for ensuring that firms operate in accordance with regulatory requirements and promote a culture of integrity and accountability. By understanding and implementing these components, firms can enable ongoing compliance and contribute positively to the financial services sector.

To Contact Us

Tel; UK 0800 689 0190, International +44 207 097 1434

Email: info@complianceconsultant.org

Or Book A Discovery Call with us by clicking the picture below!

You may also find these posts of interest – Coming Soon!

Implementing the Framework in Your Business

Case Studies of Successful Implementation

Definition and Importance of FCA Compliance

Key FCA Regulations

Consequences of Non-Compliance