-

Introduction

Compliance frameworks are structured approaches that organisations in the financial services sector implement to manage their regulatory obligations and ensure adherence to laws and standards. Given the highly regulated nature of this sector, an effective compliance framework is crucial for mitigating risks and maintaining integrity.

- Importance of Compliance Frameworks in Financial Services

In financial services, compliance frameworks serve several vital purposes. They aid in managing risks by identifying potential legal issues before they escalate into serious problems. They also help maintain organisational integrity, build customer trust, and ensure adherence to laws and standards such as GDPR and AML regulations.

- Case Study 1: Large Bank Implementing GDPR Compliance

3.1 Background of the Bank

A prominent UK bank faced the challenge of aligning with GDPR, necessitating a comprehensive compliance framework to manage customer data protection effectively.

3.2 Challenges Faced

The bank struggled with outdated data management practices, which posed risks of non-compliance and potential fines from regulators.

3.3 Implementation Steps

- Risk Assessment: Conducted an extensive audit of existing data protection processes to identify gaps.

- Stakeholder Engagement: Involved key stakeholders, including IT and legal teams, to ensure comprehensive compliance.

- Technology Integration: Implemented advanced data protection technologies to streamline data handling and enhance compliance monitoring.

3.4 Results Achieved

The implementation led to improved data protection standards, heightened customer trust, and a significant reduction in regulatory fines.

- Case Study 2: Investment Firm Enhancing Anti-Money Laundering Controls

4.1 Background of the Firm

An established investment firm sought to enhance its anti-money laundering (AML) controls to meet evolving regulatory standards.

4.2 Challenges Faced

They identified weaknesses in client verification processes, which raised concerns regarding compliance with Money Laundering Regulations.

4.3 Implementation Steps

- AML Policy Development: Created and updated policies to align with current AML regulations.

- Employee Training: Conducted regular training for employees on AML best practices and client due diligence processes.

- Monitoring Tools: Implemented sophisticated monitoring systems to detect unusual transaction patterns.

4.4 Results Achieved

The firm achieved significant improvements in compliance rates, reduced the risk of fraudulent activities, and enhanced its reputation in the market.

- Case Study 3: FinTech Company Establishing Compliance Framework

5.1 Background of the Company

A new UK-based FinTech company focused on payment processing needed to establish a robust compliance framework to operate legally.

5.2 Challenges Faced

The company faced challenges in understanding the complex regulatory landscape for financial technology firms, particularly around data security and consumer protection.

5.3 Implementation Steps

- Compliance Roadmap: Developed a detailed compliance roadmap outlining all necessary regulatory requirements.

- RegTech Solutions: Invested in regulatory technology (RegTech) solutions to streamline compliance processes and ensure real-time monitoring.

- Ongoing Compliance Training: Established continuous training programmes for employees to keep abreast of regulatory changes.

5.4 Results Achieved

The FinTech successfully launched its services, achieving full compliance with regulations, thereby gaining client trust and a competitive edge in the market.

- Best Practices for Compliance Framework Implementation in Financial Services

To effectively implement a compliance framework in financial services, organisations should:

- Conduct Comprehensive Risk Assessments: Regularly evaluate their compliance risks and vulnerabilities to stay proactive.

- Engage Stakeholders across the Organisation: Ensure effective communication and collaboration among all departments for successful implementation.

- Invest in Ongoing Employee Training and Development: Equip staff with the skills and knowledge needed to comply with regulations effectively.

-

Conclusion

As the landscape of compliance continues to evolve, financial organisations must adapt their frameworks accordingly. By learning from successful case studies and implementing best practices, they can create robust compliance structures that not only mitigate risks but also enhance trust and integrity in their operations. Effective compliance is an ongoing commitment that supports organisational resilience in the face of changing regulatory demands.

To Contact Us

Tel; UK 0800 689 0190, International +44 207 097 1434

Email: info@complianceconsultant.org

Or Book A Discovery Call with us by clicking the picture below!

You may also find these posts of interest – Coming Soon!

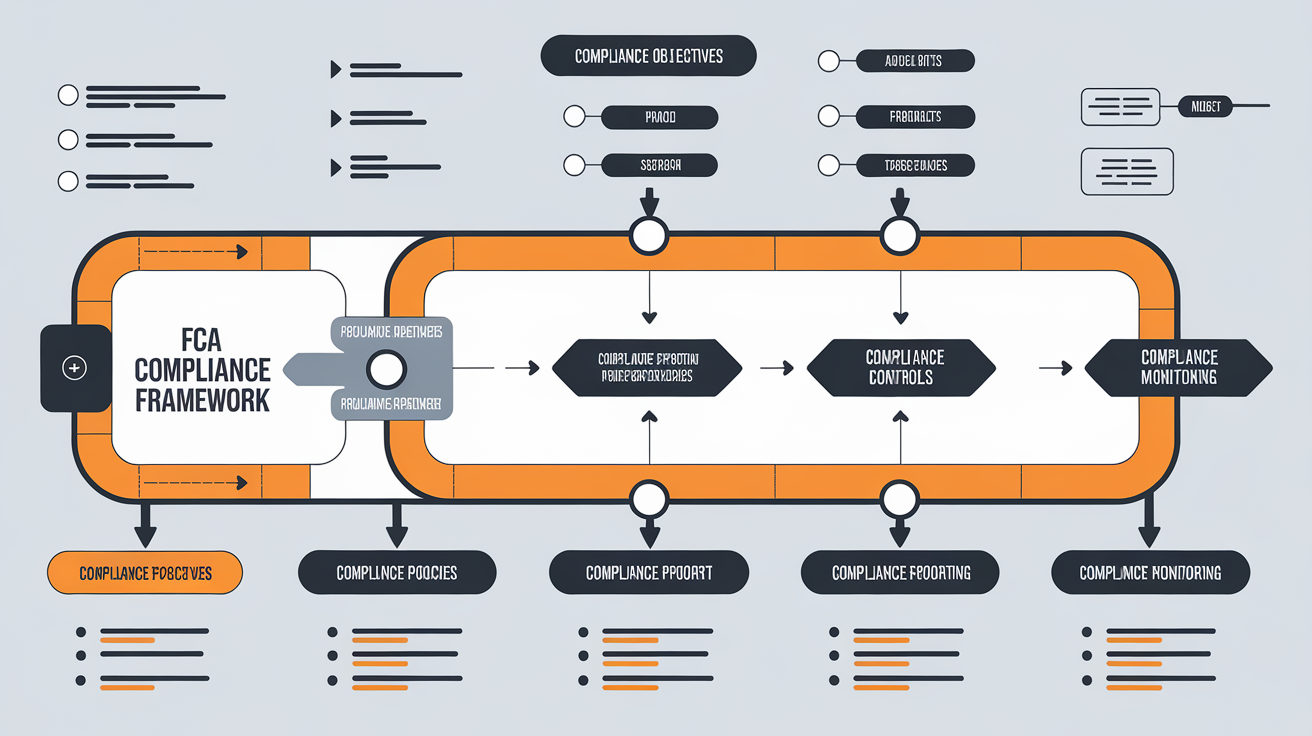

Components of the FCA Compliance Framework

Implementing the Framework in Your Business

Definition and Importance of FCA Compliance

Key FCA Regulations

Consequences of Non-Compliance