Really? A Compliance Consultant? Yes, over the years, ensuring compliance within your legal practice has become a complex challenge. You must navigate various regulations while maintaining ethical standards and client trust. Engaging Compliance Consultant can significantly enhance your approach to compliance as a COLP or COFA. In this blog post, you’ll discover the six important steps that will lead you to success in your compliance journey, ensuring your firm operates smoothly and effectively while minimising risks.

Really? A Compliance Consultant? Yes, over the years, ensuring compliance within your legal practice has become a complex challenge. You must navigate various regulations while maintaining ethical standards and client trust. Engaging Compliance Consultant can significantly enhance your approach to compliance as a COLP or COFA. In this blog post, you’ll discover the six important steps that will lead you to success in your compliance journey, ensuring your firm operates smoothly and effectively while minimising risks.

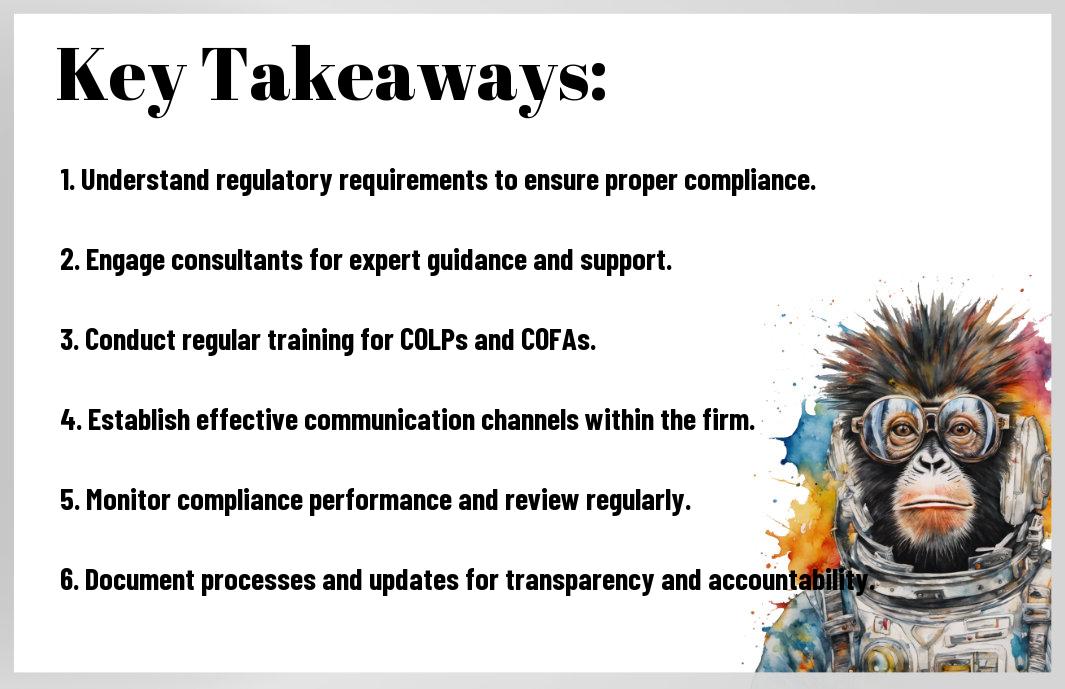

Key Takeaways:

-

Understanding the distinct roles of COLPs and COFAs is necessary for effective compliance management.

-

Engaging Compliance Consultant can provide specialised knowledge and experience, enhancing compliance strategies.

-

Regular training and updates for staff are important to maintain awareness of compliance requirements.

-

A thorough assessment of current policies and procedures should be conducted to identify areas for improvement.

-

Establishing clear communication channels and feedback mechanisms facilitates ongoing compliance success.

Understanding the Role of COLPs and COFAs

Before delving deeper into compliance, it’s necessary to grasp the pivotal roles of Compliance Officers for Legal Practice (COLPs) and Compliance Officers for Financial Administration (COFAs). These positions are fundamental in ensuring that your firm adheres to regulatory demands and maintains the integrity of its operations. By understanding these roles, you can better navigate the complexities of legal compliance, ensuring both your practice and its reputation remain intact.

Definitions and Responsibilities

COFAs are responsible for overseeing the financial operations within a law firm, ensuring compliance with regulations set by the Solicitors Regulation Authority (SRA). They supervise the handling of client funds and account management, while supporting COLPs who focus on compliance in legal practice. The responsibilities of both roles complement each other, creating a robust framework for upholding standards and managing risks.

Importance of Compliance in Legal Practice

On the surface, compliance may seem like just another box to tick, but it plays an integral part in your legal practice’s success. Ensuring adherence to regulations not only protects your firm’s reputation but also safeguards your clients’ interests, enhancing their trust in your services. Non-compliance can lead to serious repercussions, including hefty fines, damaging investigations, and potential loss of your practising certificate.

With a strong compliance framework in place, you can mitigate risks and elevate your firm’s standing in the industry. Regular audits and training sessions can empower your team, instilling a culture of accountability. Additionally, embracing compliance promotes transparency and ethical behaviour, leading to improved client relations and long-term stability for your practice. Your proactive approach to compliance not only shields you from penalties but also positions your firm as a trustworthy provider in the competitive legal landscape.

Step 1: Assessing Current Compliance Status

Assuming you are beginning to evaluate your organisation’s compliance landscape, the first step is to assess your current compliance status. This involves reviewing existing protocols to ensure they align with regulatory standards. For insights, you can refer to William A. Coull posted on the topic, providing useful guidelines for your assessment process.

Evaluating Existing Procedures

After evaluating your compliance framework, you’ll want to examine existing procedures thoroughly. This means understanding how these practices have been implemented, identifying any inconsistencies, and determining their effectiveness in meeting compliance regulations.

Identifying Areas for Improvement

Current compliance evaluations should focus on identifying areas for improvement. This step can uncover gaps in your processes, enabling you to target specific aspects that require attention.

Indeed, pinpointing areas for improvement is where you can make the most significant impact. Conducting a thorough breakdown of your compliance status will likely reveal inefficiencies or inadequacies leading to potential risks. By focusing on these weak points, you can implement enhancements that promote better compliance practices, fostering a more robust compliance culture within your organisation. This proactive approach not only mitigates risk but also strengthens your overall operational integrity.

Step 2: Engaging Compliance Consultant

After you have identified the need for external support, it is vital to engage Compliance Consultant who can assist you in navigating compliance effectively. A well-chosen consultant brings specialised knowledge and experience to your team, facilitating a smoother path to meeting regulatory obligations while enhancing the overall performance of your practice.

Choosing the Right Consultant

Above all, selecting Compliance Consultant aligns with your firm’s specific needs is paramount.

Benefits of External Expertise

Above and beyond general advice, employing a consultant provides access to valuable experience that can mitigate risks and enhance compliance. External experts often have a broader perspective and can offer innovative solutions tailored to your unique challenges.

Right from the outset, our external expertise allows you to tap into a wealth of practical knowledge that may not exist within your firm. These professionals can identify potential pitfalls and help you implement best practices swiftly, saving you both time and resources. By leveraging their skills, you are also able to ensure that your firm adheres to the ever-evolving regulations, ultimately boosting your reputation and client trust while minimising the risk of facing significant penalties.

Step 3: Developing a Compliance Framework

Once again, establishing a comprehensive compliance framework is imperative for your firm’s success. A well-structured framework acts as a foundation that supports your compliance efforts and ensures that all regulatory requirements are met efficiently. Engaging with Compliance Consultant can help you design a tailored framework that aligns with your firm’s specific needs and operational processes.

Key Components of a Compliance Framework

By understanding the key components, you can build a robust compliance framework. This includes clear policies and procedures, effective training programmes, consistent monitoring processes, and a clear communication strategy. Each aspect plays a significant role in ensuring your firm adheres to regulatory obligations and promotes a culture of compliance.

Tailoring Solutions to Unique Firm Needs

Behind every successful compliance framework lies the ability to tailor solutions to your firm’s unique requirements. Generic frameworks may not address specific risks or challenges your firm faces, leading to potential compliance gaps. It is vital that you work closely with your consultant to create bespoke solutions that effectively tackle your firm’s particular circumstances.

But, to achieve the best results, you must assess your firm’s distinct risk landscape and operational nuances. A one-size-fits-all approach can overlook critical aspects, making your firm vulnerable to compliance failures. Collaborating with Compliance Consultant enables you to develop personalised policies that address your specific regulatory challenges and enhance your overall compliance posture. Investing in tailored solutions ensures that your compliance framework is not only robust but also practical and functional, ultimately safeguarding your firm’s integrity and reputation.

Step 4: Training and Education

Unlike many aspects of compliance, effective training and education are not one-off events. Continuous education ensures that you and your team stay updated with the latest regulatory requirements and best practices, positioning your firm for improved compliance and reduced risks.

Importance of Staff Training

At the heart of compliance success is well-informed staff. Training equips your team with the necessary knowledge to navigate complex compliance landscapes, enabling them to identify potential risks and adhere to your firm’s policies effectively.

Creating a Continual Learning Environment

By fostering a culture of ongoing education, you empower your team to adapt and innovate. This dynamic approach not only keeps everyone engaged but also enhances overall compliance efficiency.

Learning should be viewed as a continuous journey rather than a destination. Encouraging ongoing professional development helps to empower your staff, creating a proactive compliance culture. By implementing regular training sessions, workshops, and seminars, you enable your team to stay informed about changes in regulations and best practices. Additionally, investing in avenues for feedback encourages open communication and a sense of collaboration, further strengthening your firm’s resolve against potential compliance pitfalls.

Step 5: Implementation and Monitoring

Despite careful planning and preparation, the real test of your compliance strategy lies in its effective implementation and thorough monitoring. This phase is not merely about putting the plan into action; it requires consistent oversight to ensure that your compliance measures are adhered to and adjustments are made as necessary. Engaging with Compliance Consultant during this process is vital to address any unforeseen challenges that may arise.

Executing the Compliance Plan

To execute your compliance plan effectively, ensure that all team members are trained and clear about their roles and responsibilities. Regular communication is key to fostering a culture of compliance within your organisation. Provide tools and resources that empower your staff to comply with regulatory standards and encourage them to voice any concerns.

Ongoing Evaluation and Adjustments

Behind every successful compliance programme lies a commitment to ongoing evaluation and necessary adjustments. This process enables you to stay ahead of evolving regulations and ensures that your strategies remain effective.

But to maintain a robust compliance framework, you must regularly assess your practices against the latest regulations and industry standards. Conduct audits and gather feedback from your team to identify weaknesses or inefficiencies in your compliance approach. Be proactive in making adjustments to your policies and training as needed, as this will help mitigate risks and enhance your organisation’s resilience. This vigilant approach not only safeguards your business from potential regulatory breaches but also fosters a culture of continuous improvement and accountability.

To wrap up

As a reminder, following the six imperative steps for ensuring compliance success as a COLP or COFA is vital in maintaining regulatory standards within your firm. By engaging with a consultant, you can gain valuable insights and tailored strategies that will enhance your compliance processes. Ensuring effective communication, conducting thorough training, and implementing regular reviews will not only safeguard your practice but also foster a culture of compliance. By prioritising these strategies, you position yourself and your firm for long-term success and stability in a rapidly evolving legal landscape.

FAQ

Q: What are COLPs and COFAs, and why are they important?

A: COLPs (Compliance Officers for Legal Practice) and COFAs (Compliance Officers for Finance and Administration) play a vital role in ensuring that legal practices adhere to regulatory requirements. They are responsible for maintaining the integrity of the firm’s operations, managing risk, and ensuring compliance with the Solicitors Regulation Authority. Their roles are necessary in safeguarding the firm’s reputation and mitigating potential legal issues.

Q: What are the six necessary steps for compliance success?

A: The six necessary steps for compliance success entail: 1) understanding the regulatory framework; 2) conducting a comprehensive risk assessment; 3) implementing robust policies and procedures; 4) providing ongoing training and support for staff; 5) conducting regular audits and reviews; and 6) engaging with a consultant for expert guidance and advice. These steps collectively enhance a firm’s compliance framework and facilitate effective governance.

Q: How can a consultant assist COLPs and COFAs?

A: A consultant can provide invaluable expertise to COLPs and COFAs by offering tailored advice based on the firm’s specific needs. They can help in the development and implementation of compliance frameworks, provide training for staff, conduct risk assessments, and ensure that all policies meet regulatory requirements. The consultant’s external perspective can also reveal areas for improvement that the internal team may overlook.

Q: What should be included in a compliance training programme?

A: A comprehensive compliance training programme should cover the regulatory obligations relevant to the practice, the role and responsibilities of COLPs and COFAs, specific compliance policies and procedures, and case studies illustrating common compliance challenges. Additionally, the programme should promote a culture of compliance within the firm, encouraging staff to engage in discussions about best practices and reporting mechanisms.

Q: How can a firm assess its compliance effectiveness?

A: A firm can assess its compliance effectiveness by conducting regular audits and reviews of its policies and procedures, measuring the adherence to regulatory requirements, and seeking feedback from employees on the practicality of compliance measures. Also, engaging an external consultant to evaluate compliance practices can provide an objective assessment and help identify gaps or areas needing enhancement.

To Contact Us

Tel; UK 0800 689 0190, International +44 207 097 1434

Email: info@complianceconsultant.org

Or Book A Discovery Call with us by clicking the picture below!

You may also be interested in

The Compliance Consultant Advantage – 10 Strong Reasons Every COLP And COFA Should Consider

10 Steps To Understand Why A Specialist Compliance Consultant Can Help COLPs And COFAs

Why A Specialist Compliance Consultant Is Your Best Ally – 7 Steps For COLPs And COFAs

Unlocking Efficiency – How A Compliance Consultant Supports COLPs And COFAs In 5 Steps

10 Steps To Understand Why A Specialist Compliance Consultant Can Help COLPs And COFAs

5 Proactive Steps – How Compliance Consultants Empower COLPs And COFAs

Why Every COLP And COFA Needs A Compliance Consultant – 9 Steps For Success

Why Every COLP And COFA Needs A Compliance Consultant – 7 Key Benefits

Really? A

Really? A