There’s a growing need for effective compliance in the legal sector, particularly for COLPs and COFAs. Engaging Compliance Consultant can help you navigate the complex regulatory landscape, ensuring your practice adheres to necessary standards. By understanding the key reasons for this crucial partnership, you can safeguard your firm against risks, enhance operational efficiency, and ultimately promote trust with your clients. This post will guide you through five compelling reasons why investing in Compliance Consultant is a smart move for your legal practice.

There’s a growing need for effective compliance in the legal sector, particularly for COLPs and COFAs. Engaging Compliance Consultant can help you navigate the complex regulatory landscape, ensuring your practice adheres to necessary standards. By understanding the key reasons for this crucial partnership, you can safeguard your firm against risks, enhance operational efficiency, and ultimately promote trust with your clients. This post will guide you through five compelling reasons why investing in Compliance Consultant is a smart move for your legal practice.

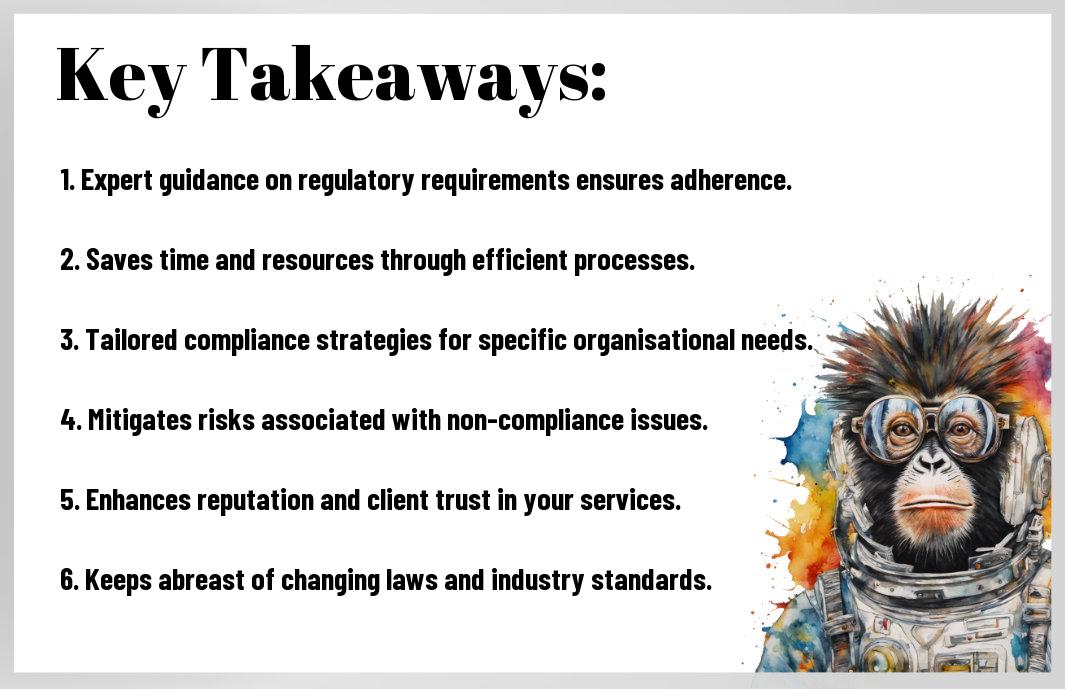

Key Takeaways:

- Compliance Consultant can provide tailored insights, helping COLPs and COFAs navigate the complex regulatory landscape effectively.

- Compliance Consultant can identify potential compliance risks early, enabling firms to address issues before they escalate into significant problems.

- The expertise of Compliance Consultant can streamline compliance processes, saving time and resources for legal businesses.

- Utilising Compliance Consultant ensures that an organisation stays updated with the latest regulations and best practices, minimising legal exposure.

- Collaboration with Compliance Consultant can foster a culture of compliance within the firm, promoting ethical practices and professional integrity.

Understanding Compliance

While compliance may seem like an intricate web of regulations, it is fundamentally about ensuring that your organisation adheres to legal standards and best practices. This understanding is pivotal for anyone in a position of responsibility, particularly COLPs and COFAs, as it safeguards not only your firm’s reputation but also its operations. By prioritising compliance, you protect your clients and build trust within the industry.

Definition and Importance

After defining compliance, it becomes evident that it encompasses adherence to laws, regulations, and guidelines relevant to your business practices. Understanding its importance is vital, as it not only protects your organisation from potential legal repercussions but also fosters a culture of integrity and accountability within your team.

Regulatory Landscape for COLPs and COFAs

About the regulatory landscape for COLPs and COFAs, it is defined by a complex array of legislation and guidelines. As a COLP or COFA, you must navigate regulations such as the SRA Code of Conduct and the Legal Services Act, ensuring your firm meets the necessary compliance standards to operate effectively.

Considering the statutory obligations, your role as a COLP or COFA carries significant responsibility for ensuring that your firm adheres to compliance requirements. Failure to comply with the SRA Code of Conduct or any relevant regulations can result in severe penalties, including sanctions against you or your firm. Thus, understanding the regulatory landscape not only safeguards your career but also enhances your firm’s reputation and operational effectiveness. Engaging with compliance consultants can help you stay informed about changes and best practices, enabling you to handle regulatory challenges with confidence.

Role of Compliance Consultant

The role of Compliance Consultant is vital for keeping your practice aligned with legal obligations and industry standards. These professionals have the knowledge to navigate complex regulations, ensuring that you avoid pitfalls that could lead to penalties or reputational damage. By collaborating with Compliance Consultant, you can dedicate more time to your core activities, knowing that your compliance needs are effectively managed.

Expertise and Experience

At the heart of Compliance Consultant‘s value lies their extensive expertise and experience in the legal sector. You benefit from their deep understanding of regulatory frameworks, allowing you to implement best practices. Their insights can help you preemptively address compliance issues, enhancing overall operational efficiency.

Tailored Compliance Strategies

About bespoke compliance strategies, Compliance Consultant develops plans specifically designed for your practice’s unique needs. These personalised strategies take into account your firm’s structure, client base, and operational objectives, ensuring that you meet all applicable regulations without unnecessary burdens.

Due to the dynamic nature of regulations, having a tailored compliance strategy is crucial for your firm’s peace of mind. With Compliance Consultant, you can implement plans that not only ensure adherence to the law but also enhance your firm’s operational resilience. This proactive approach significantly reduces the risk of non-compliance penalties, helping you maintain a positive reputation in your industry. Moreover, customised plans can lead to greater efficiency in your operations, freeing up resources to focus on client care and business growth.

Key Reason 1: Risk Management

Many firms underestimate the importance of effective risk management within their compliance frameworks. A dedicated compliance consultant can help you navigate the complexities of regulatory requirements, ensuring your organisation remains protected against various threats and potential pitfalls. By proactively identifying and addressing risks, you can maintain a strong compliance posture and safeguard your firm’s reputation.

Identifying Potential Risks

An effective compliance consultant deploys comprehensive risk assessments to identify potential risks that could impact your organisation. They possess the expertise to pinpoint vulnerabilities in your processes, systems, and practices, ensuring you are aware of any compliance gaps that may expose your firm to legal or financial repercussions.

Mitigation Strategies

For successful risk management, your compliance consultant will develop tailored mitigation strategies that align with your specific business needs. These strategies aim to reduce risks to an acceptable level while promoting a culture of compliance within your firm.

Further, implementing these mitigation strategies is vital for minimising exposure to risks that could lead to severe consequences, such as fines, reputational damage, or even legal action. Your compliance consultant will assist in creating robust policies and procedures that not only address the identified risks but also foster a proactive compliance culture among your team. This approach ensures that everyone within your firm understands their roles and responsibilities in maintaining compliance, thereby strengthening your overall position in a regulatory environment.

Key Reason 2: Efficiency and Time-Saving

After engaging Compliance Consultant, your firm will experience significant increases in efficiency and time-saving. By having an expert on board, you can streamline compliance processes, ensuring that all regulatory requirements are met without wasting valuable resources. This allows you to dedicate more time to your clients and core operations, ultimately enhancing your firm’s productivity and effectiveness.

Streamlining Compliance Processes

Reason is that Compliance Consultant can simplify the often complex landscape of regulatory requirements. They can implement standardised procedures that reduce the time spent on compliance-related tasks, allowing you and your team to work more effectively and efficiently.

Focus on Core Business Functions

By prioritising how compliance is managed, you can redirect your focus onto your core business functions, fostering growth and innovation.

In fact, delegating compliance responsibilities allows you to channel your resources towards areas that drive your firm forward, such as client engagement and service development. This not only increases operational effectiveness, but also aids in developing a responsive business strategy. When compliance is handled by an expert, your team can concentrate on what it does best, ultimately enhancing client satisfaction and driving long-term success.

Key Reason 3: Enhanced Reputation

All professionals strive to maintain a strong reputation within their industry. Compliance Consultant can significantly bolster your firm’s standing, ensuring your compliance processes are robust and transparent. This enhancement not only reflects positively on your firm but also resonates with clients, foster a sense of security and trust in your services.

Building Trust with Clients

After engaging with Compliance Consultant, your clients will have increased confidence in your ability to navigate regulatory requirements. When you display a robust compliance framework, it assures clients that their interests are protected, promoting loyalty and long-term relationships.

Maintaining Industry Standards

By remaining attentive to industry standards, you position your firm as a leader in compliance. Regular updates from your consultant ensure that you are always aligned with regulations, reinforcing your credibility among clients and peers.

And compliance is not static; it evolves with new regulations and changing market conditions. Your compliance consultant will continuously monitor and update your practices, ensuring they meet the latest standards. This proactive approach not only reduces the risk of legal issues but also enhances your reputation as a firm committed to excellence. By adhering to these high industry standards, you foster greater trust within your client base and reinforce your standing in the marketplace.

Key Reason 4: Continuous Improvement

To enhance your firm’s compliance posture, continuous improvement is vital. By engaging Compliance Consultant, you can systematically identify areas for development, ensuring you not only meet current standards but also anticipate future requirements. This proactive approach allows you to stay ahead of the competition and enhances your firm’s reputation. For more on the importance of this strategy, check out The Benefits of Outsourcing the CCO Role.

Ongoing Compliance Monitoring

After implementing compliance measures, you must consistently monitor their effectiveness. This ongoing oversight will help you identify potential gaps or weaknesses in your processes, allowing for timely adjustments. Regular assessments and updates, guided by your compliance consultant, ensure your organisation maintains the highest standards and mitigates risk effectively.

Adapting to Regulatory Changes

Between evolving regulations and unpredictable industry landscapes, your ability to adapt is crucial. A skilled compliance consultant will help you stay informed about changes affecting your organisation, enabling you to implement necessary adjustments quickly. This flexibility not only protects your business but also fosters a culture of resilience in compliance.

Regulatory environments are constantly changing, and your firm must be ready to adapt swiftly to these shifts. By working with Compliance Consultant, you can ensure that your policies and procedures are aligned with the latest regulations, reducing the risk of non-compliance. A failure to adapt could result in hefty penalties and damage to your reputation. Therefore, maintaining an agile approach allows you to seize opportunities while safeguarding your firm’s integrity and trustworthiness in the eyes of your clients and regulators alike.

Key Reason 5: Cost-effective Solution

Once again, hiring Compliance Consultant proves to be a cost-effective solution for COLPs and COFAs. By investing in expert guidance, you can avoid the financial repercussions of non-compliance, which can be far greater than the cost of consulting services. This approach not only safeguards your practice but also optimises your compliance processes, ensuring a sustainable and efficient operation.

Reducing the Cost of Non-Compliance

Across the legal sector, non-compliance can lead to hefty fines and reputational damage that may cost your firm significantly more than anticipated. By working with Compliance Consultant, you can identify potential risks and mitigate them before they escalate, saving your practice from substantial financial burdens.

Value of Expert Guidance

The right compliance consultant brings a wealth of knowledge and experience, ensuring your practice remains compliant with ever-evolving regulations. Their expertise allows you to navigate complex legal landscapes with confidence, reducing the risk of penalties and fostering a culture of compliance within your team.

Solution-focused guidance from Compliance Consultant helps you streamline your operations, aligning them with current regulations while highlighting areas for improvement. Their insights can boost your compliance strategies, educating your team on best practices and compliance requirements. This preventative approach not only safeguards your practice but also enhances client trust and your firm’s reputation. Investing in expert compliance advice is not just an expense; it is a strategic move towards a more sustainable future.

Summing up

From above, it is clear that engaging Compliance Consultant is vital for you as a COLP or COFA. Their expertise ensures you navigate the complex regulatory landscape effectively, safeguard your practice, enhance risk management, and improve your overall operational efficiency. Furthermore, they provide tailored training and support, enabling you to foster a culture of compliance within your organisation. By leveraging their specialised knowledge, you can focus on your core responsibilities while maintaining adherence to legal obligations, ultimately benefiting your practice and clients alike.

FAQ

Q: What is the role of compliance consultant for COLPs and COFAs?

A: Compliance Consultant plays a vital role in helping Compliance Officers for Legal Practice (COLPs) and Compliance Officers for Finance and Administration (COFAs) navigate the complex regulatory landscape. They provide expert guidance on compliance strategies, conduct risk assessments, and develop policies that ensure adherence to legal and regulatory standards, ultimately safeguarding the practice from potential breaches.

Q: Why is Compliance Consultant important for risk management?

A: Risk management is vital in the legal and financial sectors, where non-compliance can result in significant penalties or reputational damage. Compliance Consultant offers specialised knowledge to identify and assess potential risks, creating tailored strategies that mitigate these risks effectively. This proactive approach not only protects the organisation but also fosters a culture of compliance within the practice.

Q: How can Compliance Consultant enhance training and education for staff?

A: Compliance Consultant provides tailored training programmes for staff, ensuring they understand the latest regulations and compliance requirements. This training is vital for equipping employees with the knowledge and skills needed to perform their roles in compliance with the law. By fostering an informed workforce, practices can significantly reduce the likelihood of compliance failures.

Q: What are the benefits of having an external perspective on compliance issues?

A: Engaging Compliance Consultant offers an external viewpoint that can identify gaps or blind spots within the organisation’s existing compliance framework. This impartial analysis can lead to innovative solutions and improvements in compliance processes that may not be visible to internal staff. Furthermore, having an outside expert can enhance credibility with regulators and clients by demonstrating a commitment to best practices.

Q: How do Compliance Consultant assist with regulatory updates and changes?

A: Compliance Consultant are well-versed in the latest regulatory developments and can help COLPs and COFAs stay up-to-date with changing laws and standards. They monitor these changes closely and provide timely insights and recommendations, ensuring that the practice can adapt swiftly and maintain compliance. This ongoing support alleviates the burden on internal teams, allowing them to focus on their core responsibilities.

To Contact Us

Tel; UK 0800 689 0190, International +44 207 097 1434

Email: info@complianceconsultant.org

Or Book A Discovery Call with us by clicking the picture below!

You may also be interested in

The Compliance Consultant Advantage – 10 Strong Reasons Every COLP And COFA Should Consider

10 Steps To Understand Why A Specialist Compliance Consultant Can Help COLPs And COFAs

Why A Specialist Compliance Consultant Is Your Best Ally – 7 Steps For COLPs And COFAs

Unlocking Efficiency – How A Compliance Consultant Supports COLPs And COFAs In 5 Steps

10 Steps To Understand Why A Specialist Compliance Consultant Can Help COLPs And COFAs

5 Proactive Steps – How Compliance Consultants Empower COLPs And COFAs

Why Every COLP And COFA Needs A Compliance Consultant – 9 Steps For Success

Why Every COLP And COFA Needs A Compliance Consultant – 7 Key Benefits

Never Before Heard of COLPs And COFAs Tips on How To Leverage Working With Compliance Consultant

The Ultimate Guide – 8 Steps On Why Compliance Consultants Are Vital For COLPs And COFAs

There’s a growing need for effective compliance in the legal sector, particularly for COLPs and COFAs. Engaging Compliance Consultant can help you navigate the complex regulatory landscape, ensuring your practice adheres to necessary standards. By understanding the key reasons for this crucial partnership, you can safeguard your firm against risks, enhance operational efficiency, and ultimately promote trust with your clients. This post will guide you through five compelling reasons why investing in Compliance Consultant is a smart move for your legal practice.

There’s a growing need for effective compliance in the legal sector, particularly for COLPs and COFAs. Engaging Compliance Consultant can help you navigate the complex regulatory landscape, ensuring your practice adheres to necessary standards. By understanding the key reasons for this crucial partnership, you can safeguard your firm against risks, enhance operational efficiency, and ultimately promote trust with your clients. This post will guide you through five compelling reasons why investing in Compliance Consultant is a smart move for your legal practice.