In the intricate landscape of the UK’s financial sector, a robust FCA Compliance Framework is paramount for financial organisations operating within this jurisdiction. Such a framework provides a structured approach to ensuring adherence to the regulations set forth by the Financial Conduct Authority (FCA). The importance of this compliance structure cannot be overstated, as it serves to safeguard both financial firms and their customers. As the financial services landscape continues to evolve, those businesses that prioritise a comprehensive and effective compliance framework will not only mitigate risks but also enhance their reputational standing and customer trust.

Understanding the FCA Compliance Framework

- What is the FCA?

The Financial Conduct Authority (FCA) is an independent regulatory body established to oversee the financial markets and firms operating within the UK. Its primary mandate is to ensure that the financial system operates fairly and transparently. The FCA has the authority to create and enforce regulations aimed at protecting consumers, enhancing competition, and promoting the integrity of the financial services sector.

Compliance with FCA regulations is not merely a matter of legal obligation; it is critical to maintaining the overall integrity of the marketplace, ensuring that consumers are treated fairly, and that firms operate within the bounds of the law. The FCA’s overarching aim is to protect consumers from malpractice, while also ensuring that firms provide quality services and products.

- Importance of FCA Compliance

Failure to comply with FCA regulations can result in significant consequences for financial institutions. Non-compliance may lead to hefty fines, operational restrictions, and damage to a firm’s reputation—all of which can be detrimental to a business’s viability and sustainability.

Moreover, FCA compliance underscores the principle of acting in the best interest of consumers. Adhering to these regulatory expectations enhances trust among stakeholders and promotes confidence in the financial system as a whole. For firms, a commitment to compliance can result in competitive advantages, improved customer loyalty, and greater operational efficiency.

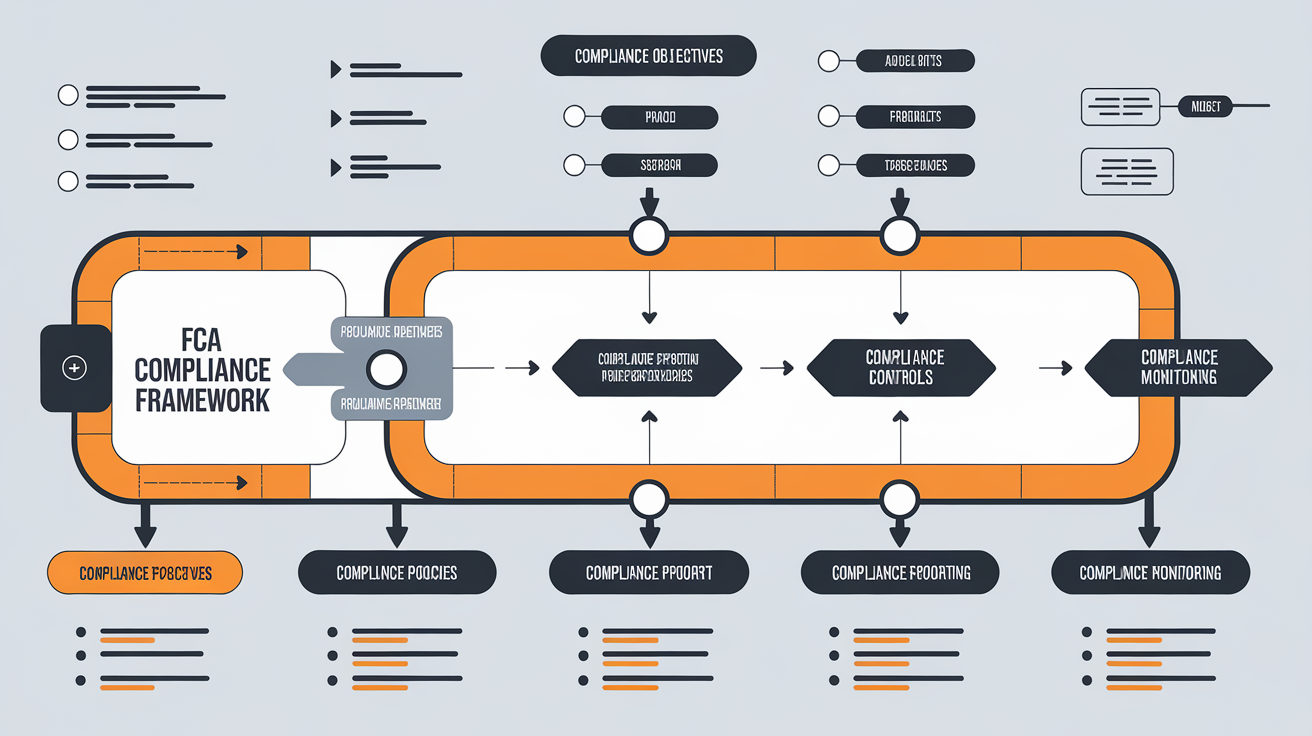

Key Components of the FCA Compliance Framework

A well-defined FCA Compliance Framework comprises several critical components that collectively ensure adherence to regulations.

- Policies and Procedures

Organisations should establish clear policies and procedures that delineate their compliance obligations. This includes detailed documentation of the steps the firm will take to comply with relevant regulations. Key elements should include:

- Code of Conduct: A guideline for expected behaviours and ethical standards within the firm.

- Compliance Manual: A comprehensive manual outlining compliance requirements, regulatory obligations, and procedures for various scenarios.

- Policy Documentation: Clear and accessible documents detailing specific compliance-related processes, including data protection and anti-money laundering (AML) measures.

Ensuring that all employees are familiar with these guidelines is crucial for fostering a culture of compliance throughout the organisation.

- Risk Assessment

Regular risk assessments are essential to identify and mitigate potential compliance risks. This process involves:

- Identifying Activities: Evaluating the firm’s activities to understand where compliance risks may arise.

- Understanding Associated Risks: Analysing the various risks linked with these activities, including operational, reputational, and financial risks.

- Implementing Controls: Developing and implementing control measures to address identified risks, thereby reducing the likelihood of non-compliance.

By conducting thorough risk assessments, firms can proactively address vulnerabilities and enhance their overall compliance posture.

- Training and Awareness

An informed workforce is imperative for a successful compliance framework. Continuous staff training helps cultivate a culture focused on compliance. Key aspects include:

- Regular Training Sessions: Host frequent training programmes that focus on FCA regulations and organisational compliance policies. Incorporate real-world scenarios to demonstrate the significance of compliance.

- Awareness Campaigns: Use internal communications to promote understanding of compliance issues, share updates on regulations, and highlight the importance of ethical behaviour.

Engaging employees in compliance training not only fosters awareness but also empowers them to take ownership of their responsibilities in ensuring adherence.

- Monitoring and Reporting

A system that allows for continuous monitoring of compliance is necessary for maintaining adherence standards. This includes:

- Regular Audits: Conducting scheduled audits to identify non-compliance issues and areas for improvement.

- Assessment Procedures: Implementing ongoing assessments to ensure that compliance processes remain effective and aligned with regulatory changes.

Firms should establish clear procedures for reporting findings, allowing issues to be escalated to senior management and, when necessary, to the FCA.

- Record Keeping

Maintaining appropriate documentation is crucial for demonstrating compliance. Effective record-keeping includes:

- Documentation of Policies: Ensuring that updated compliance policies and procedures are readily accessible.

- Training Records: Keeping detailed records of employee training sessions, including attendance and content covered.

- Audit Findings: Documenting results from audits and assessments, as well as actions taken to address issues identified.

Proper documentation serves as evidence of compliance efforts and provides a valuable resource for regulatory audits.

Steps to Implement an FCA Compliance Framework

Establishing an FCA Compliance Framework involves a series of defined steps designed to promote adherence to FCA regulations.

- Conduct a Compliance Audit

A compliance audit is an essential first step, aimed at assessing a firm’s current adherence to FCA regulations. This process involves:

- Reviewing Practices: Evaluating all aspects of the firm’s operations, including policies, procedures, and actual practices against FCA requirements.

- Identifying Areas for Improvement: Pinpointing non-compliance issues and developing action plans to address them.

Conducting regular compliance audits helps financial organisations maintain a high standard of compliance and ensure that any deficiencies are promptly addressed.

- Develop a Compliance Strategy

A comprehensive compliance strategy is a cornerstone of an effective FCA Compliance Framework. This strategy should:

- Define the Approach: Clearly articulate the firm’s approach to regulatory adherence, identifying specific compliance objectives.

- Align with Business Goals: Ensure that the compliance strategy aligns with the firm’s overall business objectives and operational needs.

- Tailor to Regulations: Consider the specific regulations pertinent to the firm’s industry, ensuring that the strategy is relevant and actionable.

Creating a robust compliance strategy not only facilitates regulatory adherence but also supports the organisation’s strategic goals.

- Engage Key Stakeholders

Involving senior management and employees in compliance initiatives is crucial for fostering a culture of compliance. This can be achieved by:

- Regular Management Meetings: Conducting meetings that focus on compliance updates, challenges, and performance metrics.

- Building Cross-Departmental Teams: Establishing teams that represent various departments to ensure that compliance is a shared responsibility throughout the organisation.

Engaging stakeholders reinforces the importance of compliance as a collective priority and encourages a commitment to regulatory adherence.

- Regular Reviews and Updates

Compliance frameworks must be dynamic and adaptable to ongoing changes in regulations and internal processes. This necessitates:

- Periodic Reviews: Regularly reviewing compliance policies and practices to assess their effectiveness and relevance.

- Updating Practices: Making timely updates to compliance frameworks in response to new FCA regulations or internal operational shifts.

By conducting regular reviews, organisations can remain agile in their compliance efforts and ensure that they are well-positioned to adapt to evolving regulatory landscapes.

Challenges in Maintaining FCA Compliance

Despite the importance of a robust compliance framework, firms often face various challenges in maintaining FCA compliance. These can include:

- Evolving Regulations

The financial services sector is characterised by rapidly changing regulatory requirements. Keeping abreast of these changes can be a daunting task for firms. To address this challenge, organisations should:

- Establish Monitoring Systems: Set up systems to track FCA updates and relevant regulatory changes, ensuring that compliance practices are aligned.

- Engage with Professional Bodies: Maintaining active membership in industry associations can offer valuable insights into emerging compliance trends and best practices.

By proactively monitoring regulatory changes, firms can ensure that they remain in compliance and avoid potential pitfalls.

- Resource Allocation

Effective compliance requires adequate resources, which may not always be readily available. To overcome resource-related challenges, firms might consider:

- Prioritising Compliance Efforts: Allocating dedicated resources to compliance initiatives, thereby ensuring that compliance is seen as a business-critical function.

- Budgeting Wisely: Developing a detailed budget that reflects the necessary investments in compliance tools, training, and personnel.

Appropriate resourcing is essential for maintaining effective compliance, particularly in an environment characterised by increasing regulatory scrutiny.

- Cultural Resistance

Cultural resistance to compliance initiatives can hinder progress. Overcoming this challenge necessitates:

- Leadership Support: Securing buy-in from senior management to champion compliance initiatives across the organisation.

- Promoting a Positive Compliance Culture: Fostering a work environment where compliance is viewed as a core value, encouraging staff to embrace compliance principles in their daily activities.

By building a strong compliance culture, organisations can facilitate smoother implementation of compliance initiatives and mitigate resistance.

Benefits of a Robust FCA Compliance Framework

The advantages of implementing a comprehensive FCA Compliance Framework are numerous and far-reaching. Key benefits include:

- Enhanced Reputation

A strong compliance framework enhances a firm’s reputation in the market. By consistently demonstrating regulatory adherence, firms can foster consumer trust and loyalty. Customers are more likely to engage with organisations that prioritise ethical practices and compliance.

- Reduced Risk of Penalties

Maintaining compliance significantly reduces the risk of incurring fines and sanctions from the FCA. By adopting a proactive approach to compliance, firms can safeguard their financial wellbeing and minimise potential liabilities.

- Improved Operational Efficiency

A well-structured compliance framework streamlines processes and workflows, ultimately enhancing overall organisational performance. Efficient compliance management leads to better resource allocation, reduced redundancies, and improved productivity across departments.

Additionally, with a strong compliance foundation in place, firms can focus on delivering high-quality products and services rather than expending resources to address compliance issues after they arise.

Conclusion

In conclusion, establishing an FCA Compliance Framework is fundamental for all financial organisations operating within the UK. By understanding its key components and implementing effective practices, firms can significantly enhance their operational integrity and protect themselves from regulatory repercussions.

Embracing a culture of compliance not only safeguards the organisation but also benefits customers and the financial market as a whole. As the financial landscape evolves, organisations that invest in robust compliance frameworks will be better positioned to navigate regulatory challenges and seize opportunities for growth. Continuous improvement in compliance practices will ultimately ensure long-term success and resilience, enabling firms to thrive in a competitive environment marked by constant change and increased scrutiny.

To Contact Us

Tel; UK 0800 689 0190, International +44 207 097 1434

Email: info@complianceconsultant.org

Or Book A Discovery Call with us by clicking the picture below!

You may also find these posts of interest – Coming Soon!

Understanding FCA Compliance

Components of the FCA Compliance Framework

Implementing the Framework in Your Business

Case Studies of Successful Implementation